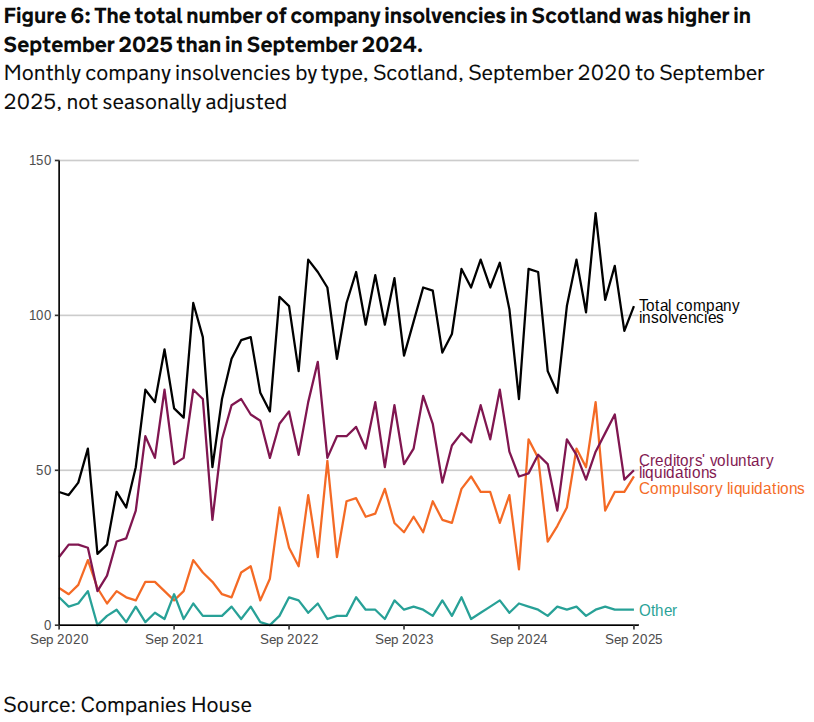

In Scotland last month there were 103 company insolvencies, which was eight more than last month. It is also 41% higher than the same month last year.

September’s total was made up of 50 Company Voluntary Liquidations (up from 47 in August); 48 compulsory liquidations (up from 43) and five administrations (no change). There were no Company Voluntary Arrangements (no change) or receivership appointments.

Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB), Scotland’s insolvency service, administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26th 2020 and September 30th 2025, there were three restructuring plans and one moratorium in Scotland. Both procedures were created by the Corporate Insolvency and Governance Act 2020.

Scotland had always traditionally seen more compulsory liquidations than any other kind of insolvency process but CVLs overtook them in April 2020 and had remained higher until March 2025.

CVLs again became the most frequent form last month overturning a three-month trend when compulsory liquidations had been higher.

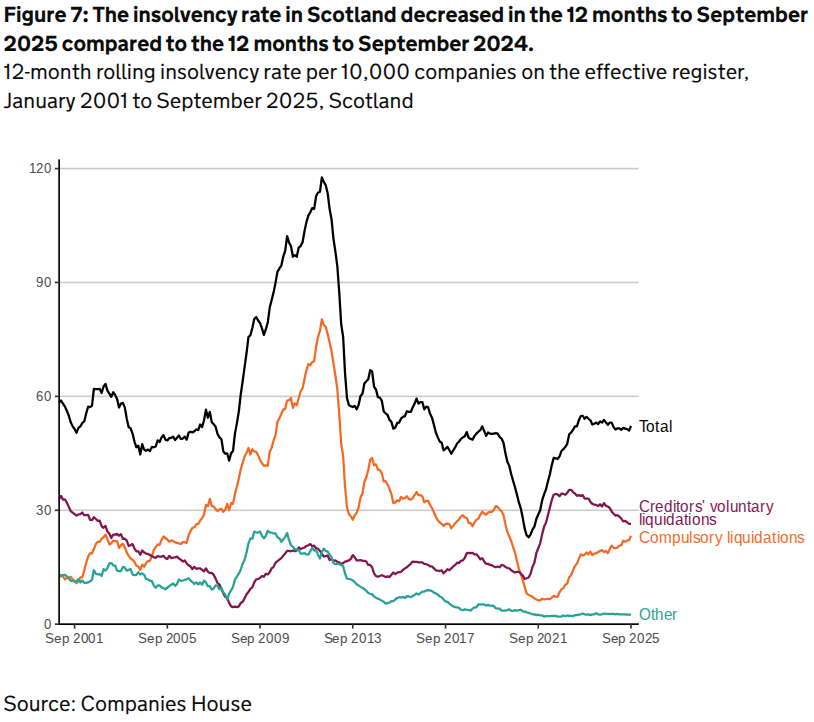

The total insolvency rate in Scotland in the 12 months to September 2025 was 52.2 per 10,000 companies on the effective register. This was up by 1.2 from the preceding 12 months ending September 2024.

The total number of company insolvencies for the whole of the UK in September 2025 was 2,131 – a month-on-month decrease of 22.

One in six UK businesses have no cash reserves

Chris Horner, insolvency director with BusinessRescueExpert, said: “It’s apparent that the pressure on businesses will intensify next year – especially if higher inflation becomes entrenched as predicted recently by the IMF.

“This would keep consumer demand low and borrowing costs high, which maintains the acute squeeze on margins and revenues that are currently challenging Scottish firms.

“The Budget next month could be decisive in shaping the near-term operating landscape. Anything that further dampens consumer confidence or raises business costs could be the final straw for struggling companies, particularly hospitality firms that have endured a difficult 12 months.

“They will be hoping that the Chancellor introduces confidence building measures that encourage investment, recruitment and expansion rather than further increasing the tax burden which could worsen cashflow problems for businesses which might already be struggling.

“Ongoing challenges such as higher energy and materials costs, cautious consumer demand and creditor pressure have combined with slower than anticipated reductions in the cost of borrowing to leave some businesses fighting hard to stay afloat.

“This pressure is reflected in the latest Office for National Statistics business insights data, which revealed that around one in six (17%) UK trading businesses reported having no cash reserves in late September 2025 – the highest proportion since the question was introduced in June 2020.

“This is deeply concerning, as a lack of cash reserves leaves businesses particularly vulnerable to even small financial shocks, such as a bad debt or loss of a customer, challenges which they might previously have been able to weather. It suggests insolvency activity is likely to remain at the current level for some time.”

We’re on the brink of the clock’s going back – when time itself changes – and so many directors looking to make the vital changes their business needs understand that the time to do it is now.

Get in touch with us to arrange a free initial consultation about what options you could have to help your business be in the best possible shape for the last few months of 2025 and beyond.