What does this mean for individual businesses and the wider economy?

We’ve been writing about the consequences and importance of County Court Judgements (CCJs) being awarded against businesses for several months now – and specifically how there is a high correlation between companies receiving them and eventually having to go into insolvency.

Ongoing research from The Registry Trust shows that there is a 1,126% increase in the number of companies receiving a CCJ then going into administration or closing through liquidation afterwards within the past four years.

The data shows that for a company receiving a CCJ within a six-year window the average time between receiving a judgement against them and becoming insolvent was seven months.

More than a third of these (35%) became insolvent after receiving one judgement.

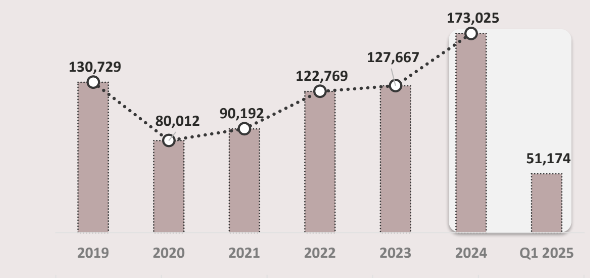

Looking at the latest statistics for corporate CCJs, we can see that their upward trend continues.

Figures from The Registry Trust.

While the Covid-19 affected years of 2020 and 2021 saw large reduction in the number of businesses receiving CCJs, these numbers recovered strongly in 2022 and 2023 although it was only last year when the total was greater than the last pre-Covid year of 2019.

Although it reached this number with 42,000 more CCJs being awarded annually for a total of 173,025.

49,089 of these judgments took place in England and Wales and is a 48.9% increase from the previous quarter and a 33.8% increase from the same period a year ago (Q1 2024).

There were 165,399 commercial CCJ judgements registered in England and Wales last year, which was an annual increase of 36.6%.

So far, the first quarter of 2025 shows a total of 51,174 companies receiving a CCJ against them – a trend which would see another annual increase if it continues at this pace throughout the rest of the year and is already over a third of the total commercial judgement total seen last year.

The risks of a CCJ

Every company that receives a CCJ is at a higher risk of insolvency than other businesses but sole traders are in even more jeopardy.

This is because Limited companies enjoy specific legal protections when it comes to their business debt which is not shared by a sole trader. If they were to receive a CCJ then they would be expected to settle any outstanding debts from their own personal assets or accounts.

Remember, a CCJ is not like a winding-up petition, which has legal standing to compel companies to repay their debts.

Instead it gives High Court Enforcement Officers (HCEOs) and bailiffs the legal right to visit business premises (including the home of a sole trader if they are one and the same) and seize company assets up to the value of any outstanding debts.

Any CCJ is also publicly available for view on the Register of Judgements, Orders and Fines so any creditor, customer or supplier can find it.

This will make future borrowing more expensive and difficult to obtain as an unpaid CCJ remains on a business’s credit file for six years.

Chris Horner, insolvency director with BusinessRescueExpert, said: “It doesn’t necessarily mean that a business receiving a CCJ will automatically go into insolvency but the data and ongoing trends show that it’s a distinct probability.

“Given our experience over 15 years, we’d agree with this assessment and stress to any director or business owner that if they or their business receives a CCJ then they should get in touch as a matter of urgency.

“Depending on the individual circumstances of a business, they will probably have more options then they think they have and we will most likely be able to work with them to create an effective and efficient roadmap to a sustainable and brighter future.”