What other important numbers from March do you need to know?

We’re not sure how much vindication can be given to the pundits who’ve been predicting a spike in corporate insolvencies for months because it’s always been likely.

But now The Insolvency Service have published their latest set of monthly company insolvency statistics for the month of March which shows that not only has a spike arrived, it’s a big one – so they can at least claim to have been right.

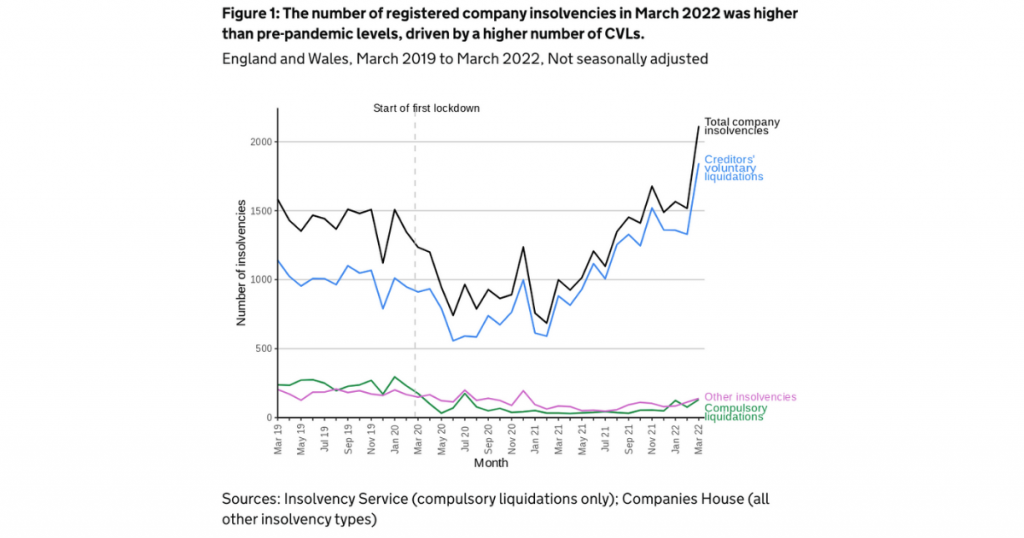

The total number of corporate insolvencies for March is 2,114 – 39% higher than the 1,515 recorded in February and more than double the 999 recorded a year previously. The total is also 34% higher than the 1,582 recorded in March 2019 and is the highest monthly total in over two years.

It also continues the trend of being the eleventh consecutive month when the number of corporate insolvencies was both over 1,000 and higher than the corresponding total in the same month 12 months ago.

Digging into the underlying details of the 2,114 English and Welsh insolvencies, the overwhelming majority remain Creditor Voluntary Liquidations (CVLs) with 1,844 CVLs recorded which makes up 87% of the total amount.

This amount is up on the 1,329 recorded last month as well as being more than double the total of March 2021 and 62% greater than the pre-pandemic total in March 2019.

In addition to this amount of CVLs there were a total of 131 compulsory liquidations (up from 74 in February); 129 administrations (up from 109 last month) and 10 company voluntary arrangements (CVAs) (up from 3 last month).

A closer break down of these figures shows:

- There were nearly four times as many compulsory liquidations (297%) in March 2022 compared to a year ago. This figure is also striking because the restrictions on winding up petitions and creditors’ actions remained in place when these figures were recorded. As these were lifted at the end of March, we can expect that this number will rise from April onwards. Although growing, the figure is still 45% lower than the number from March 2019.

- 129 administrations is 74% higher than a year ago and is the highest amount recorded in 15 months since December 2020. This is a clear indication that businesses are seeking options to restructure themselves and their debts as a viable alternative to closing down or liquidation although it is still 26% lower than that recorded in pre-pandemic 2019.

- The 10 CVAs recorded is a monthly increase and is at the same level as March 2021 but remains 66% lower than in March 2019.

- There were no receivership appointments made in March 2022.

Additionally 36 insolvency moratoriums have been obtained since they were introduced in the Corporate Insolvency and Governance Act in June 2020 and ten businesses had their restructuring plans registered at Companies House.

Scotland

There were a total of 86 company insolvencies recorded in Scotland in March.

This was 13% higher than the previous month and double the number from a year ago in March 2021 but is still 11% lower than the pre-pandemic level of March 2019.

The total was made up of 71 CVLs (up 11 from February), nine compulsory liquidations (down one from last month) and six administrations (up from three) with no CVAs or receivership appointments recorded for the sixth consecutive month.

The Insolvency Service continues to note that while compulsory liquidations were traditionally the main driver of company insolvencies in Scotland, since April 2020 there have been nearly three times as many CVLs as there have been compulsory liquidations.

Northern Ireland

In Northern Ireland there were 20 company insolvencies (up two from last month) – which is almost three times as many as in March 2021 but still remains 35% lower than in March 2019.

The total was made up of seven compulsory liquidations (down three from last month), 12 CVLs (up from four last month) and four administrations (up from one) with no CVAs or receivership appointments recorded.

The total number of UK company insolvencies for March 2022 is 2,220 which is 614 higher than the 1,606 recorded in February.

Collectively, the figures from January, February and March make up the first financial quarter of the year and the 5,197 company insolvencies recorded across the three months make it the highest quarterly total recorded since Q3 of 2017.

“A situation which looks unlikely to change in the near future”

Colin Hague, President of R3, the insolvency and restructuring trade body, said: “The increase in corporate insolvencies in March was driven by an increase in the number of creditor voluntary liquidations (CVLs), a procedure initiated by directors of insolvent firms to close their company, which were almost 40% higher than the previous month.

“This suggests that many company directors have seen the increasingly difficult short-medium term economic prospects as something they won’t be able to overcome and have closed their companies ahead of time.

“The figures reflect the challenge UK businesses continue to face. They have gone from trying to trade through a global pandemic to trading while the costs of fuel and energy rise, and while staff are concerned about whether their wages can cover the increased costs of living. Both firms and individuals have barely had time to draw breath and market conditions are far from ideal.

“While spending is higher than it was this time last year and in 2019, rising inflation has meant people are spending the majority of their money on general living costs.

“Consumer confidence is low as people are concerned about their finances and the future of the economy, and with inflation rising, they’re reluctant to make major purchases. This is a situation which looks unlikely to change in the near future.

Chris Horner, insolvency director with BusinessRescueExpert, said: “One of the reasons why you could see a huge increase in the number of CVLs was the impending withdrawal of government support and the ending of restrictions on creditors and commercial landlords taking action against businesses.

“The recent increase in interest rates has also made it more expensive for businesses to service their debts and huge increases in energy costs might have pushed companies that were just about on the financial edge over it.

“In many ways and depending on what sector you’re operating in, this period could be as challenging as it was during the pandemic but without any government support. Consumers are certainly undergoing a cost of living crisis but businesses will be too.

“HMRC will also be eager to begin to recover outstanding corporation tax and VAT arrears which will mean businesses will have even less room to manoeuvre than they might have thought they had.”

Even if you’re right about something, it doesn’t necessarily follow that you’ll be happy about it.

Especially if it happens at one of the worst possible times.

Since March 2020 when the first lockdowns were announced to combat the pandemic, UK businesses have had the most uncertain trading conditions for several generations and these look like they’ll actually be getting worse in the short term.

Even well run and profitable businesses will have difficulties maintaining sales as customers begin to tighten their belts as taxes and bills rise simultaneously.

But one thing that separates these companies from the rest is the speed at which they look to solve problems rather than letting them grow and ultimately become too big to fix.

They will be able to offer a range of strategies and options fully tailored to their situation and can also give them some other possible solutions that they could implement.

But only if they make the easiest decision first and get in touch to set one up.