The last month of 2025 saw monthly reductions in all insolvency categories

While the country was gearing up for Christmas and New Year’s Eve Celebrations, the economy was continuing to work in the background and we now have a full picture of the month with the latest corporate insolvency figures for December 2025, released by The Insolvency Service.

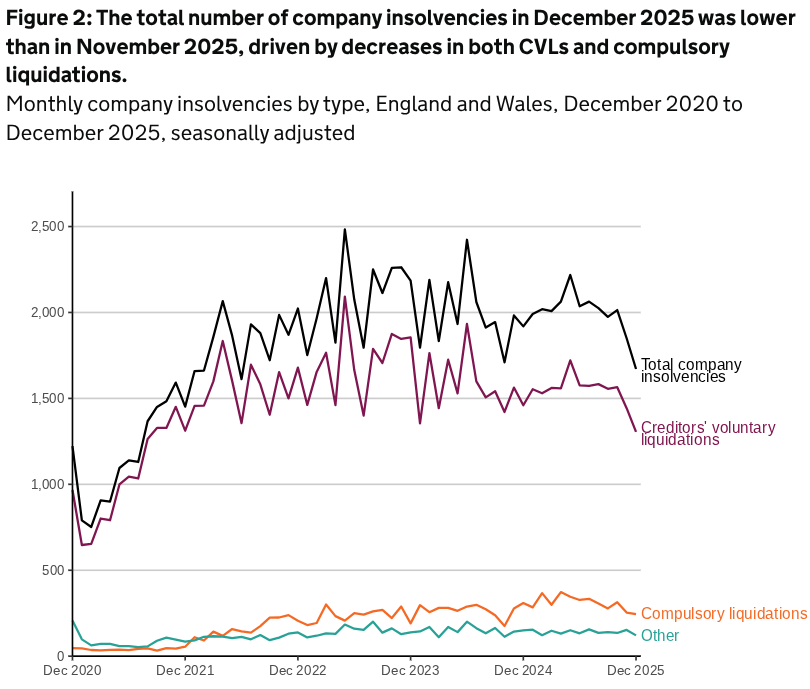

There were a total of 1,671 registered company insolvencies last month, which was 10% lower than in the previous month and 13% lower than in the same month in the previous year. This was to be expected as December is usually a quieter month than November and was for the third consecutive year.

Analysis

Of the 1,671 corporate insolvencies recorded in December, the most frequent kind remains Creditors’ Voluntary Liquidations (CVLs) with 1,305 – the lowest monthly total of CVLs seen since August 2021.

The total was 10% lower than the previous month and 11% lower compared to December 2024 although CVLs accounted for 78% of all company insolvencies, the same ratio as the previous month.

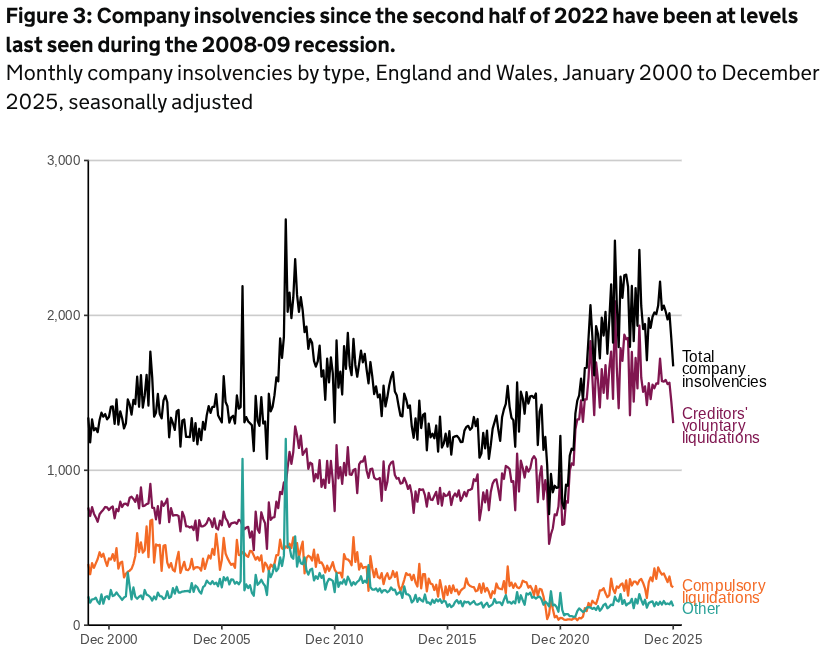

In 2025, CVL volumes slightly decreased by 2% from 2024 and by 10% from the record-high number registered in 2023. The past four years as a whole have seen the highest four totals of CVLs since records began in 1960. Between 2017 and 2019, CVLs had been rising at approximately 10% a year but during the Covid pandemic, they fell to their lowest levels since 2007.

There were a total of 245 compulsory liquidations in December. This was 4% lower than in November and 21% lower than the previous year’s equivalent.

2025 saw compulsory liquidations at their highest levels since 2012, increasing by 15% on their 2024 level. This continues the increase from their record low levels seen in 2020 and 2021 when restrictions were put in place on the use of statutory demands and winding-up petitions.

HMRC is continuing to target companies that have outstanding arrears in Corporation Tax, VAT, PAYE and National Insurance Contributions (NICs) with more resources being allocated to their recovery and investigation which will only continue throughout the rest of 2026.

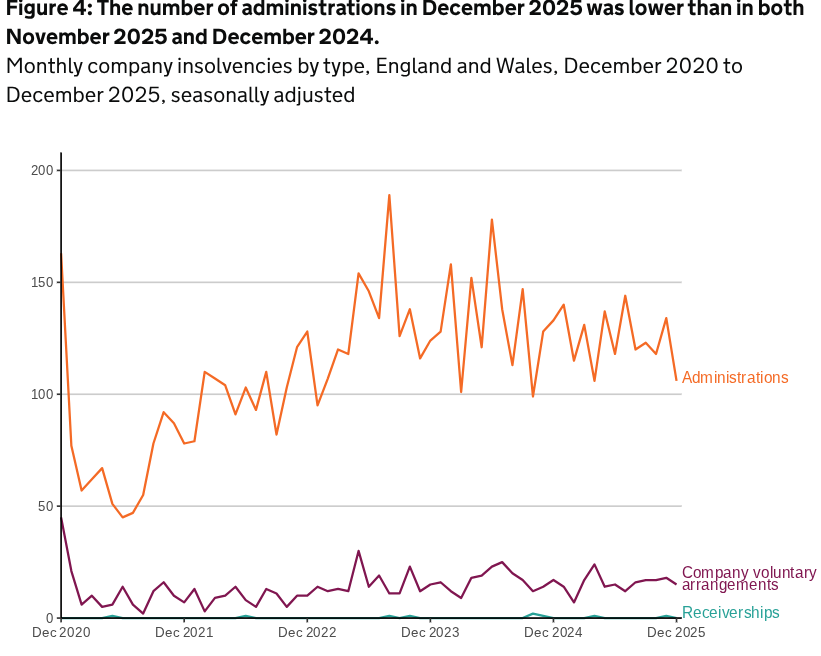

There were 106 administrations in December 2025 which was 21% lower than the previous month and 20% lower than in December 2024.

The number of administrations decreased in 2025 annually by 8% which follows a sustained increase from 2022 to 2024 after the 18-year-low seen during the pandemic.

There were 15 Company Voluntary Arrangements (CVAs) in December which was 17% lower than the previous month and 12% lower than the same month a year previously. These numbers are low compared to historical levels. In 2025 as a whole, CVAs were lower than in 2024 but similar to 2023. Overall the number of CVAs in 2025 remained 47% lower than the annual average from 2015 to 2019.

There were no receivership appointments in December with only two being registered in the previous twelve months.

There were no moratoriums and one restructuring plan registered at Companies House in December 2025. Between June 26 2020 and December 31 2025, 67 companies obtained a moratorium and 57 companies had a restructuring plan registered. There were eight moratoriums and 22 restructuring plans registered in 2025.

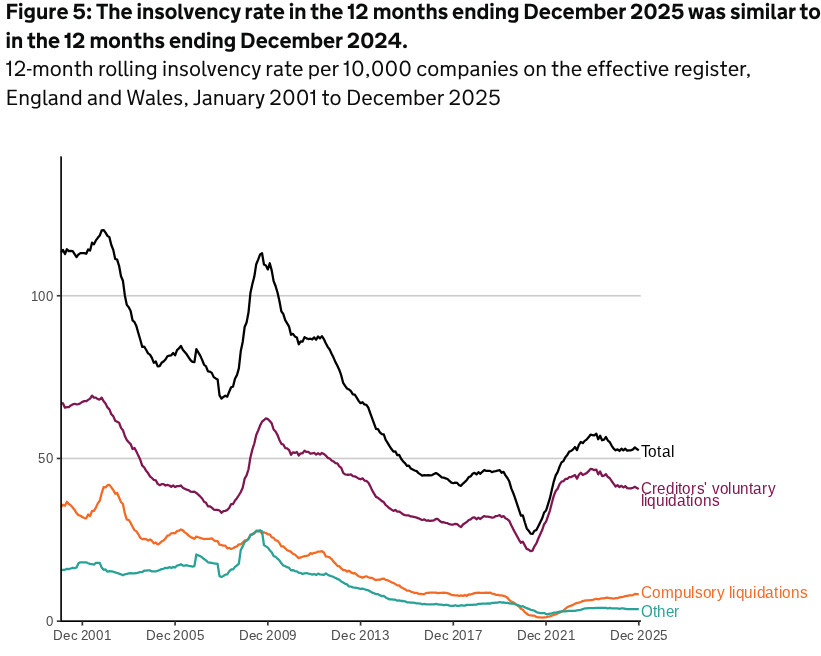

The rolling company liquidation rate in the 12 months to December 2025 was 52.5 per 10,000 companies on the effective register in England and Wales which corresponds to one in 190 entering insolvency. This is a slight decrease from last month (52.9 per 10,000 companies or one in 189 companies.)

These insolvency rates are calculated as a proportion of the total number of companies on the effective register and are more comparable over longer time periods than the absolute numbers. A 12-month rolling rate is presented to reduce the volatility associated with estimates based on single months.

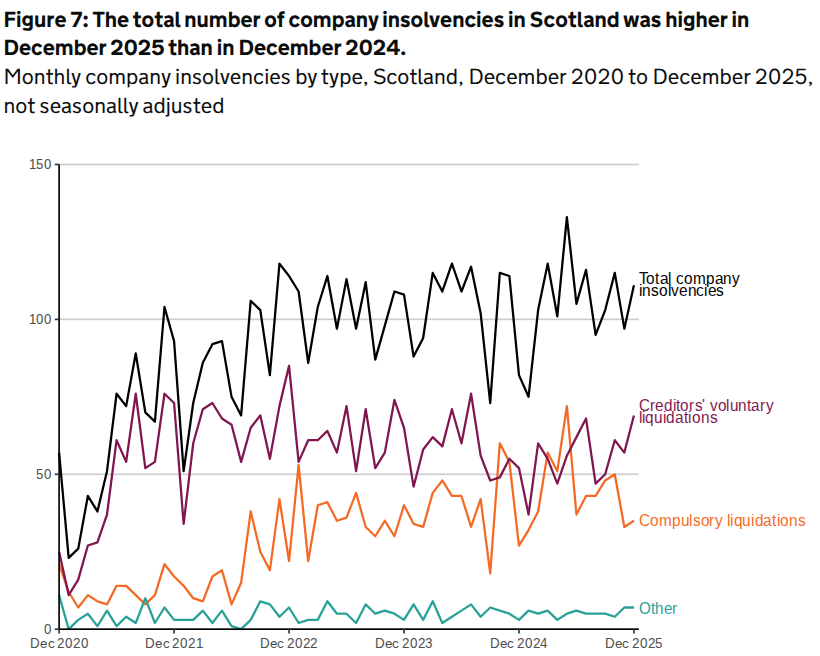

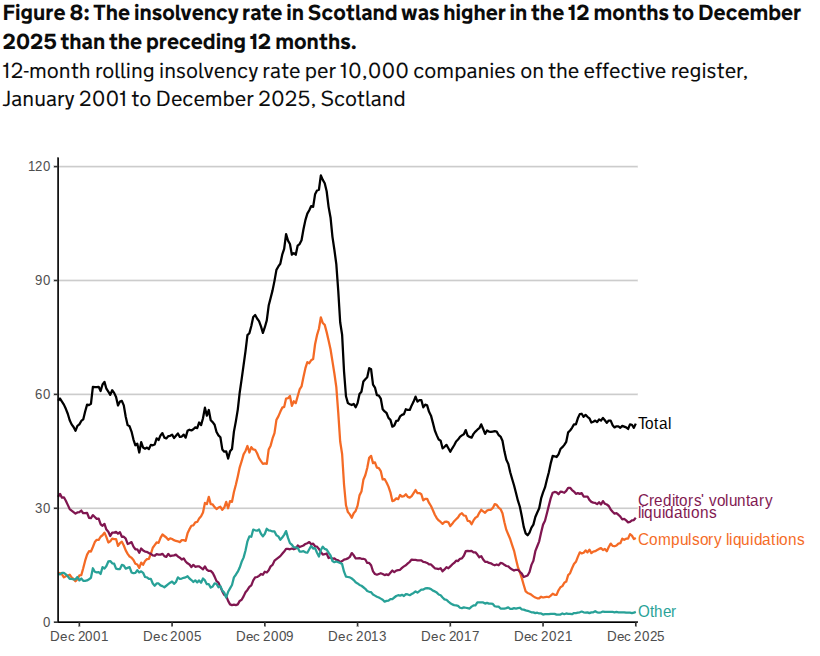

Scotland

In December there were 111 company insolvencies registered in Scotland which was 35% higher than the same month last year.

The total number of company insolvencies was comprised of 69 CVLs (up 11); 35 compulsory liquidations (up two) and seven administrations (no change). There were no CVAs or receivership appointments.

It’s important to note that Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB) is Scotland’s insolvency service and administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26th 2020 and December 31st 2025, there were three restructuring plans and one moratorium in Scotland.

Scotland has always traditionally recorded more compulsory liquidations than any other kind of insolvency procedure but CVLs overtook them in April 2020 and remained higher until a three month period from March 2025, when they retook the higher position.

The total insolvency rate in Scotland in 2025 was 52.3 per 10,000 companies on the effective register which was up 0.4 from 2024.

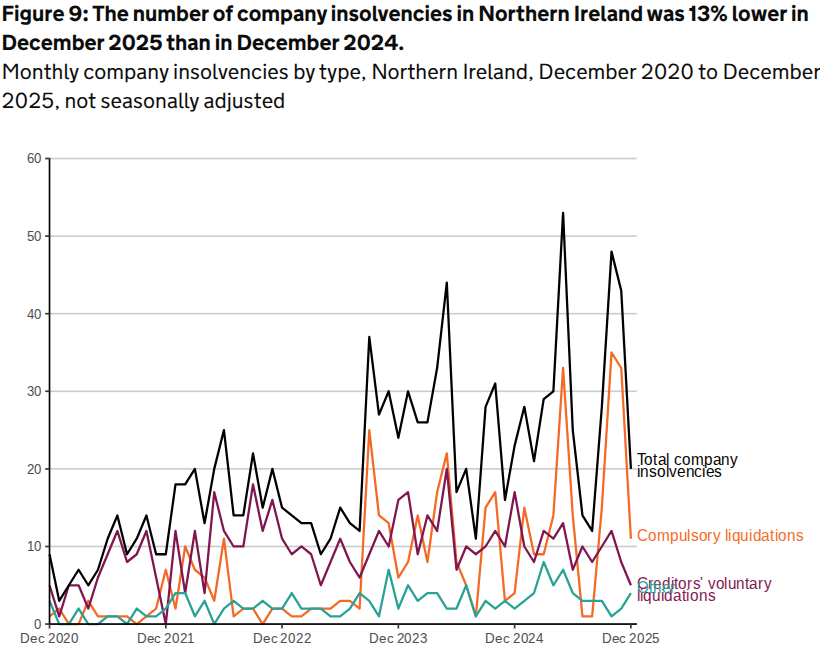

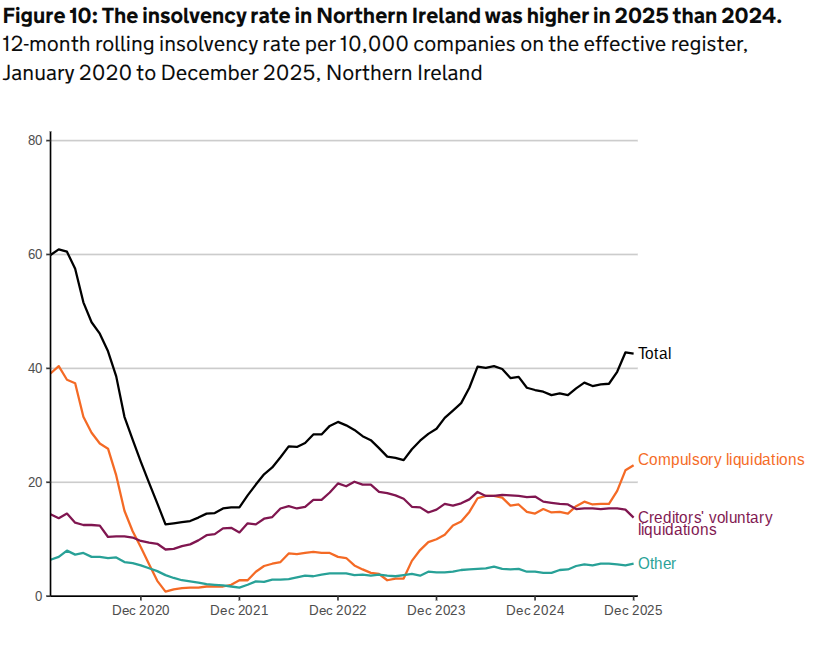

Northern Ireland

In December there were 20 company insolvencies registered in Northern Ireland, which was 13% lower than in December 2024.

The total number of company insolvencies in the province was comprised of 11 compulsory liquidations (down 22); five CVLs (down three) and four CVAs (up two). There were no administrations or receivership appointments.

Between June 26th 2020 and December 31st 2025, there was one moratorium in Northern Ireland and no restructuring plans.

The total insolvency rate in 2025 in Northern Ireland was 42.6 per 10,000 companies on the effective register which was an increase of 6.4 from 2024.

The total number of company insolvencies for the whole of the UK in December 2025 was 1,802 – a month-on-month decrease of 205.

Chris Horner, insolvency director with BusinessRescueExpert, said: “This is the third December in a row where the number of business insolvencies have been less than the previous month’s total.

“What is surprising is when we hear that some directors believe this is just the start of a trend and there will be less in 2026. There is not much evidence to suggest that this will be the case.

“HMRC are beginning their recruitment drive to hire an additional 5,000 compliance officers so expect compulsory liquidations to increase. This will also drive more business owners and directors to seek CVAs or to place their businesses into administration to buy them time to restructure and find solutions to their financial problems. Unfortunately even those seeking professional advice early might have left it too late and will have to voluntarily liquidate these firms – which will increase these numbers too.”

2026 might just be getting going but if it feels like your business hasn’t got into gear yet – don’t worry because there is still time to kickstart your progress.

Get in touch with us for a free initial consultation about the options you could have to help you create and work through a feasible plan and strategy no matter what your short and medium term goals for the year.