But remain at near decade highs

2025 is already in the rearview mirror as the economy and your business motors ahead to a hopefully positive 2026.

But it’s important to understand what position the economy is in and what prevailing undercurrents and factors could be at work this year. So the latest corporate monthly insolvency figures from The Insolvency Service are of tremendous interest because they give us the full picture.

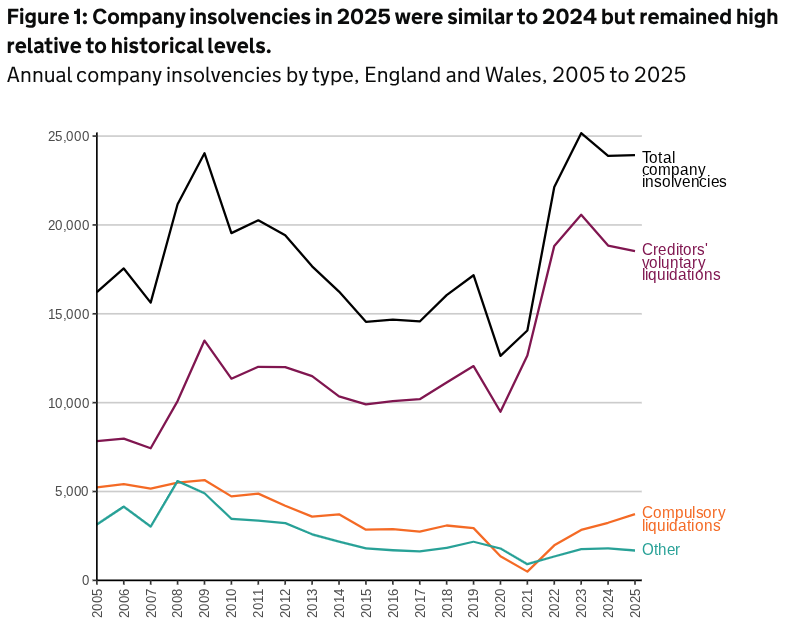

There were a total of 23,938 registered company insolvencies which is slightly higher than the 2024 total of 23,880 (0.2%). Nevertheless, it remains the second highest total in the past decade, only beaten by 2023’s 25,164.

Overall there was a slight decrease in Creditors’ Voluntary Liquidations which was balanced by an increase in compulsory liquidations to the highest annual number since 2012. The past four years have seen the highest four numbers of CVLs since the time series began in 1960.

2025 saw administrations decrease by 6% from 2024 and Company Voluntary Arrangements (CVAs) similarly down by 8% annually.

Of the 23,938 registered company insolvencies, 18,525 were CVLs, 3,730 compulsory liquidations, 1,495 administrations, 186 CVAs and two receivership appointments.

CVLs made up 77% of the total with compulsory liquidations (16%), administrations (6%) and CVAs (1%) following.

The six industries that experienced the highest number of insolvencies in the 12 months up to November 2025 were:-

- Construction (3,950 – 17% of cases)

- Wholesale and retails trade (3,773 – 16% of cases)

- Accomodation and food service activities (3,372 – 14% of cases)

- Administrative and support service activities (2,451 – 10% of cases)

- Professional, scientific and technical activities (1,983 – 8% of cases)

- Manufacturing (1,970 – 8% of cases)

One in 190 businesses on the Companies House effective register (at a rate of 52.5 per 10,000 companies) entered insolvency in 2025, the same as in 2024.

The 2025 insolvency rate is much lower than the peak of 113.1 per 10,000 seen during the 2008/09 recession, even though 2024 and 2025 saw similar numbers of insolvencies to 2008 and 2009. This is because the number of companies on the effective register has more than doubled.

Scotland & Northern Ireland

There were 1,272 company insolvencies registered in Scotland in 2025. This is the highest total seen in a decade although similar to the totals in 2024 (1,236) and 2023 (1,234). Compulsory liquidations were 13% higher than in 2024 and 23% higher than in 2023.

CVLs, administrations, CVAs and receivership appointments were all similar to the numbers seen in 2024.

In Northern Ireland, there were 351 company insolvencies last year – the highest total recorded since 2019.

This was a 15% increase from 2024 (305 insolvencies) and was largely driven by a 56% increase in compulsory liquidations although the number of CVLs decreased by 22%. Administrations increased by 47% and CVAs increased by 16%.

Tom Russell, R3 President, said: “Corporate insolvencies in 2025 remain at historically high levels with nearly 24,000 businesses becoming insolvent. Difficult trading conditions, high overheads and the impact of the national insurance rise weighed heavily on businesses last year.

“Compulsory liquidation levels have increased to their highest annual number in thirteen years as creditors take firmer action to recover debts to manage pressures in their own businesses.

“While Creditors’ Voluntary Liquidation numbers over the past four years are at their highest levels since records began in 1960.

“Although inflation has begun to ease and economic growth has picked up slightly, 2025 was a year in which many businesses were on fragile ground financially. The lasting effects of elevated costs, restricted access to finance and subdued customer demand continues to stretch cashflow, particularly for small and mid-sized firms.

“This ongoing strain is reflected in business confidence levels which, according to a survey from the Institute of Chartered Accountants in England and Wales, remain at a three-year low.

“Construction continued to be the most distressed sector last year with 3,950 companies entering insolvencies which accounted for 17% of industries captured. Major housebuilders are also forecasting static growth and muted demand this year due to market uncertainty and rising building costs. Retail and hospitality also remained the second and third most distressed sectors.”

2026 might just be getting going but if it feels like your business hasn’t got into gear yet – don’t worry because there is still time to kickstart your progress.

Get in touch with us for a free initial consultation about the options you could have to help you create and work through a feasible plan and strategy no matter what your short and medium term goals for the year.