What other interesting stories happened this May?

One of the most curious things about the post-Covid world we’re living in is how some things have reverted to a pre-Covid “normal” status and others have changed irrevocably.

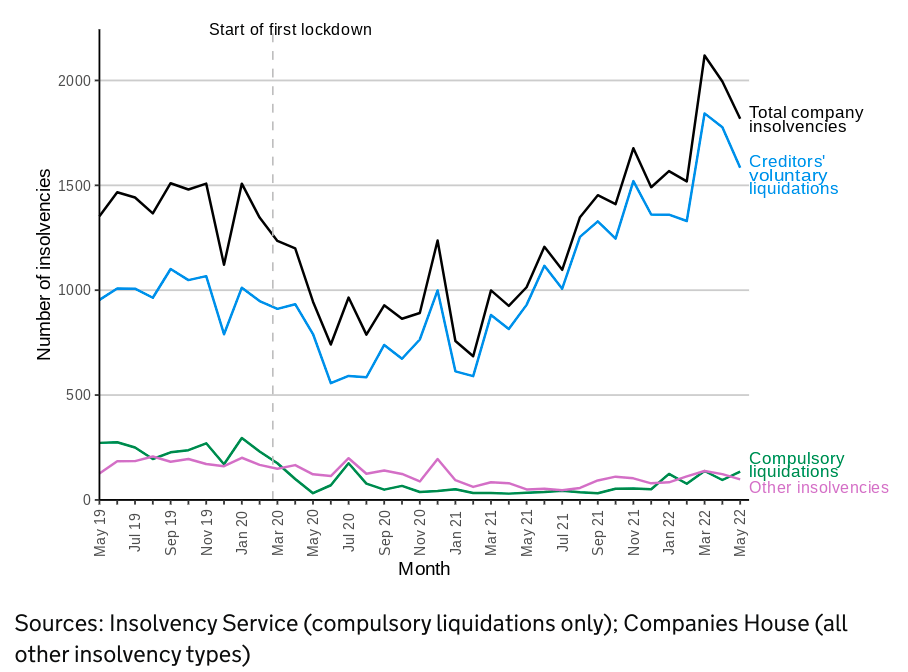

We can see this duality in the latest corporate insolvency statistics for the month of May that have just been published by the Insolvency Service.

On the one hand, the total number of corporate insolvencies was 1,817 – which was 178 fewer than the total in April so it looks like demand for insolvencies and liquidations to be dropping.

However, this total is still the third highest recorded in the previous three years and is both 79% higher than the total recorded in May 2021 and 34% higher than the May 2019 number – its latest pre-pandemic equivalent.

It’s also the thirteenth consecutive month when the number of corporate insolvencies was both over 1,000 and higher than the corresponding total in the same month a year ago.

Looking in more detail at the 1,817 total of English and Welsh insolvencies, the majority are Creditor Voluntary Liquidations (CVLs) with 1,584 which is 87% of the total number.

This is 193 fewer than last month’s total but remains the third highest total in three years as well as 70% higher than a year ago and 66% higher than pre-pandemic May 2019.

The story becomes more nuanced when we look at the other types of insolvency procedures.

There were a total of 135 compulsory liquidations including winding up petitions (up from 95 in April); 84 administrations (down from 113 last month) and 14 company voluntary arrangements (CVAs) (up from 10 last month).

Looking closer at these figures shows some interesting trends:-

The 135 compulsory liquidations was four times higher (297%) than a year ago although 50% lower than in April 2019. This is mainly being driven due to creditors resuming recovery actions such as winding up petitions and the courts enforcing them.

14 CVAs taken in pre-Covid isolation may look low and indeed is 55% lower than in May 2019 but is up 133% from a year ago and has now grown in four consecutive months.

Administrations are down slightly to 84 from 113 last month but are still 95% higher than 12 months ago. They remain down slightly at 12% fewer than in May 2019.

Once again there were no receivership appointments recorded.

The Insolvency Service notes that between June 26 2020 and May 31 2022 there were 38 insolvency moratoriums obtained in England and Wales and 12 companies had their restructuring plans registered at Companies House.

Scotland

In Scotland, 93 company insolvencies were registered in May, one higher than a month ago. This total was 82% higher than a year previously and 19% higher than in May 2019.

This consisted of 19 compulsory liquidations, 68 CVLs and six administrations. There were no CVAs or receiverships recorded.

Traditionally, the volume of Scottish company insolvencies has been mainly driven by compulsory liquidations but since April 2020 there have been more than three times as many CVLs recorded.

Northern Ireland

In Northern Ireland there were 20 company insolvencies, up from the 13 recorded in April. This figure is more than two and a half times greater than the number from a year ago but remains 50% lower than in May 2019.

This total is made up of 17 CVLs and three compulsory liquidations.

The total number of UK company insolvencies for May 2022 is 1,930 which is 166 lower than the 2,096 recorded in April.

May is the second month of Q2 and in comparison with the first two months of 2022 already has 725 more insolvency cases already indicating that Q2 will see a big increase when the official figures are released later in the year.

Christina Fitzgerald, the President of R3, the insolvency and restructuring trade body, said:

“The monthly fall in corporate insolvencies has mainly been driven by a reduction in Creditors’ Voluntary Liquidations.

“However, numbers for this process and for overall corporate insolvencies are higher than this time last year, the year before that and in 2019.

“This suggests that while the current economic challenges are continuing to hit businesses hard and are pushing an increased number into insolvency, insolvency trends themselves are still uneven.

“In recent months, firms have been buffeted by rising costs, falling consumer confidence and reluctance to spend on anything other than the essentials, which has meant they haven’t made the additional income they need to offset increased expenditure.

“There simply hasn’t been time to draw breath between the issues caused by the pandemic and those now arising from our current economic challenges, and many businesses who have survived so far are now starting to struggle – and rising interest rates will only add extra costs for firms to deal with.”

Chris Horner, insolvency director with BusinessRescueExpert, believes that we’re still in the foothills of what could be a mountain of forthcoming company insolvencies this year.

He said: “We can see from these figures and also from anecdotal evidence and experience that many businesses are choosing to liquidate their business and have the certainty of the final decision made rather than try to battle on and have increasing worries in the difficult months ahead.

“As well as rises in nearly every expense, bill, charge and tax, businesses with outstanding corporation tax or VAT arrears or overdue bounce back loan repayments are also going to be worried about increasing recovery actions from HMRC to recover any additional funds they can.

“Many otherwise viable businesses are struggling to free themselves from debt arrears which in normal circumstances would be manageable but with the cumulative effect of all the other increases on top including interest rate rises, means that all of a sudden they aren’t able to deal with them.”

The line between a manageable and unmanageable problem for a business is a thin one and the only difference between them is often time.

If a company’s owners or directors react quickly enough and get some professional advice early then they will have sufficient time to implement any necessary decisions and changes to allow them to continue to trade through the difficult environments.

Businesses that don’t get help until it’s too late will find their range of options narrowed sometimes to only involve how closure is done if a recovery strategy is untenable.

The best strategy for any concerned director is to take advantage of the free, virtual consultation offered whenever they want one.

Once we have all the necessary information and more details about the unique situation facing the business then we’ll be able to work with them to highlight all the available options and choices they have, what each one entails and what their next steps should be to implement them and hopefully see their situation improve quickly.

This can only happen if they take the wisest decision they can and get in touch with us first while they still have some time to change the path their company is on.