While everyone was preparing for Christmas and Hogmanay, the Scottish economy kept on going until New Years’ Eve.

Now The Insolvency Service have released the data on what was happening with insolvencies in Scotland last month and it’s interesting reading.

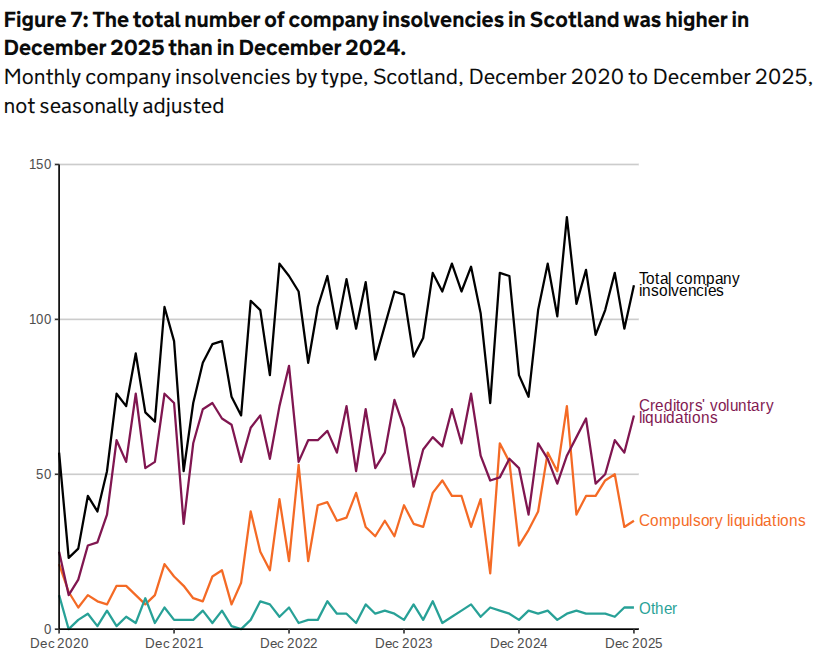

In December there were 111 company insolvencies registered in Scotland which was 35% higher than the same month last year.

The total number of company insolvencies was comprised of 69 CVLs (up 11); 35 compulsory liquidations (up two) and seven administrations (no change). There were no CVAs or receivership appointments.

It’s important to note that Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB) is Scotland’s insolvency service and administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26th 2020 and December 31st 2025, there were three restructuring plans and one moratorium in Scotland.

Scotland has always traditionally recorded more compulsory liquidations than any other kind of insolvency procedure but CVLs overtook them in April 2020 and remained higher until a three month period from March 2025, when they retook the higher position.

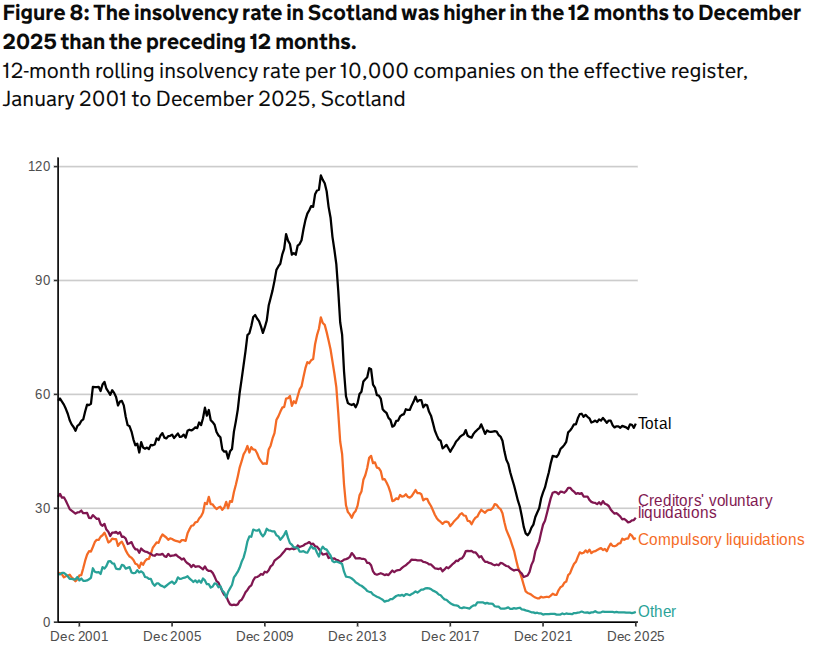

The total insolvency rate in Scotland in 2025 was 52.3 per 10,000 companies on the effective register which was up 0.4 from 2024.

The total number of company insolvencies for the whole of the UK in December 2025 was 1,802 – a month-on-month decrease of 205.

Chris Horner, insolvency director with BusinessRescueExpert, said: “While Scotland’s business insolvencies have fluctuated before rising again, liquidations – voluntary and involuntary have continued to rise and that’s what we’ll be keeping an eye on in 2026.

“HMRC are beginning their recruitment drive to hire an additional 5,000 compliance officers so expect compulsory liquidations to increase. This will also drive more business owners and directors to seek CVAs or to place their businesses into administration to buy them time to restructure and find solutions to their financial problems.

“Unfortunately even those seeking professional advice early might have left it too late and will have to voluntarily liquidate these firms – which will increase these numbers too.”

2026 might just be getting going but if it feels like your business hasn’t got into gear yet – don’t worry because there is still time to kickstart your progress.

Get in touch with us for a free initial consultation about the options you could have to help you create and work through a feasible plan and strategy no matter what your short and medium term goals for the year.