Voluntary and compulsory liquidations also rise last month

In Scotland last month there were 115 company insolvencies, which was 12 more than last month. It was exactly the same total from October 2024.

The total from October 2025 was made up of 61 CVLs (up from 50); 50 compulsory liquidations (up from 48) and four administrations (down from five). There were no CVAs (no change) or receivership appointments.

It’s important to note that Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB) is Scotland’s insolvency service and administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26th 2020 and October 31st 2025, there were three restructuring plans and one moratorium in Scotland. Both procedures were created by the Corporate Insolvency and Governance Act 2020.

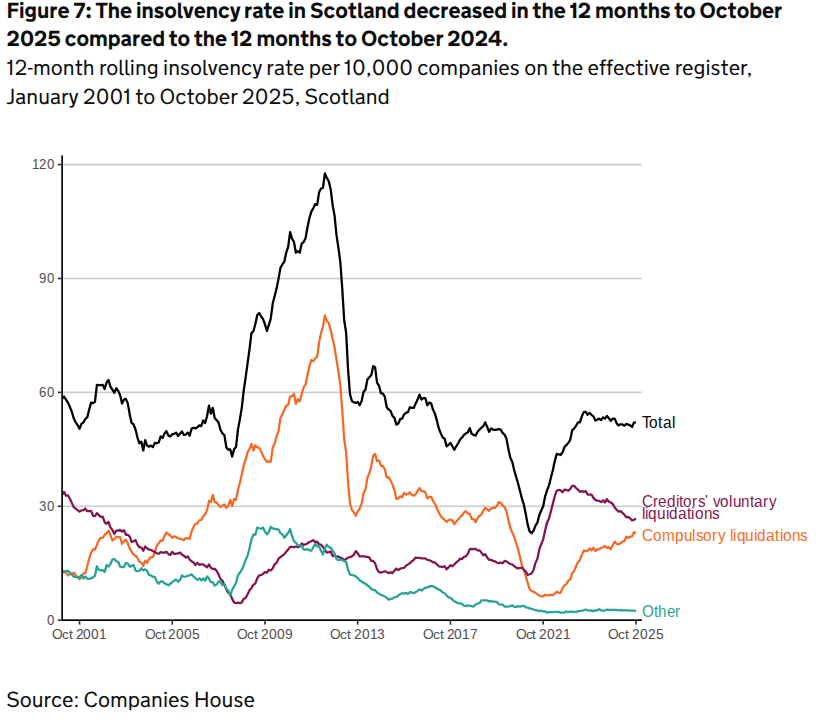

Scotland has always traditionally recorded more compulsory liquidations than any other kind of insolvency procedure but CVLs overtook them in April 2020 and remained higher until a three month period from March 2025, when they retook the higher position.

The total insolvency rate in Scotland in the 12 months up to the end of October 2025 was 52 per 10,000 companies on the effective register. This was slightly down (0.2%) from the preceding 12 months ending in October 2024.

The total number of company insolvencies for the whole of the UK in October 2025 was 2,192 – a month-on-month increase of 61.

Chris Horner, insolvency director with BusinessRescueExpert, said: “Next month’s Budget could be decisive and meaningful in ways we haven’t seen for directors for years.

“Usually we have a good idea of what measures are going to be included but nearly a week away, nothing can be certainly accounted for except the time and date it’s taking place. With consumer confidence still precarious and business costs liable to rise – although as to which ones and by how much are still a mystery – it could be the final straw for many struggling firms.

“Alternatively, the Chancellor could use the platform to introduce confidence building measures for businesses that will encourage investment, recruitment and expansion rather than increasing the tax burden and make cashflow problems for businesses worse.”

While the nation celebrates qualifying for a World Cup again, the good feeling might not transfer to businesses facing similarly tough challenges.

But like Steve Clarke, you have enough time to make the changes that can turn things around in time.

Get in touch with us to arrange a free initial consultation about what options you could have to help your business be in the best possible shape for the last few months of 2025 and beyond.

Things could look very different for your business by the time the World Cup kicks off in 2026 – but only if you start now.