The final statistics are in from the Accountant in Bankruptcy (AiB) who administer corporate insolvencies in Scotland so we now have the full picture for the financial year 2023/24 and it’s not a great one for Scottish firms.

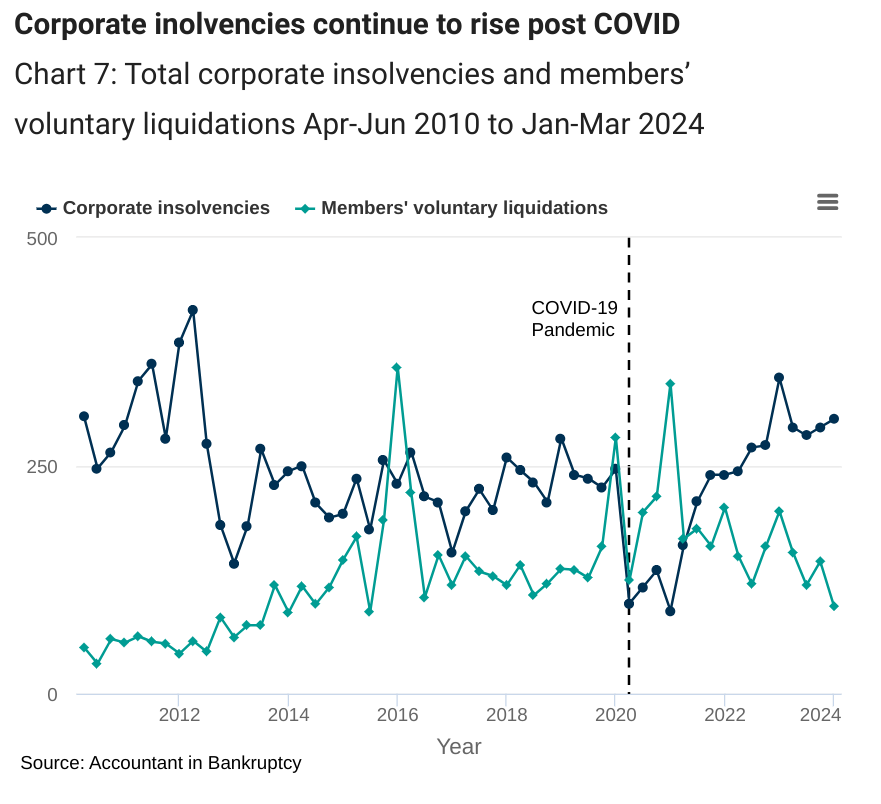

Businesses in Scotland are going into insolvency at their highest rate for more than a decade.

Aggressive creditors chasing outstanding debts to bolster their own positions; high rent, energy and raw material costs along with higher wage demands, interest rates at a decade high and inflation still above the Bank of England’s target rate of 2% have all contributed to the total of 1,168 Scottish company insolvencies between April 1 2023 and March 30 2023.

This is a 3% year on year increase on the last financial year and is the highest total recorded since 2012/13 (1,369).

In the latest figures released from the AiB, last year’s figure was 23% higher than the last pre-pandemic period of 2019/20.

One of the main drivers in the rise of Scottish corporate insolvencies has been the leap in compulsory liquidations, which have grown by almost a third from last year.

Compulsory liquidations have increased by more than 31% as creditors seek to use winding up petitions and statutory demands to force debtors into court and get them closed down in an attempt to realise their assets and recoup some of the outstanding owed amounts.

Creditors voluntary liquidations (CVLs) have fallen slightly compared to the last financial year but the total is still double that of pre Covid’s 2019/20 as more directors liquidate their businesses in an increasingly harsh trading climate.

We can also see that Members voluntary liquidations (MVLs), which is when directors close a solvent business voluntarily, has fallen year on year since their peak in 2020/21.

Richard Bathgate, Chair of insolvency trade body R3 in Scotland, said: “Even though the figures represent a modest increase on last year, corporate insolvency in Scotland is at its highest level since the 2011/12 financial year as the economic climate continues to affect the nation’s business.

“Compulsory liquidations have increased by more than 31% compared to last year as creditors chase down debt in an attempt to balance their own books, although it should be noted numbers for this process are still below pre-pandemic levels.

“Creditors voluntary liquidation (CVL) levels have fallen slightly compared to last year, but 2023’s total is still more than double 2019’s.

“The biggest issues businesses in Scotland have faced over the last year are volatility in consumer confidence and the high costs of rent, energy and raw materials. All of these have contributed to a difficult year for firms and forced their directors to balance rising operational costs with the demands of a workforce seeking higher salaries.

“Last April’s hike in Corporate Tax to 25% also added further strain on the finances of Scottish businesses. Directors are already having to keep a close eye on their profit margins, and this additional cost, along with further cost increases from all other angles, has only made it more challenging to keep cash flow steady.

“Looking ahead, while there’s some optimism for a gradual economic recovery in 2024, this may come too late for some businesses. It’s clear that many directors are still having to make tough decisions about their long-term future, and it may be some time before we see insolvency numbers fully stabilise.

“Given the economy’s ongoing uncertainty, Scottish businesses will need to remain alert and adaptable over the coming months if they are to keep up with market conditions that appear to be changing almost every day, and Scotland’s business owners and directors will need to be alert to the signs of financial distress and act as soon as they show themselves.

“There are many reasons why businesses and individuals find themselves facing financial difficulties. But whatever the reason, the best thing anyone in this situation can do is to seek advice as early as they possibly can.

“Talking about money can be really hard, but by speaking to a qualified professional at the earliest signs of financial distress, you’ll have more time to think about your next steps and more options for dealing with your concerns than if you’d waited for the situation to spiral.”

We echo the sentiments of R3 and would ask any Scottish business owners or directors that don’t like what they see on the horizon for their company to take early action to help themselves.

They can always talk to their accountants who are best placed to spot signs of impending insolvency and/or a licensed insolvency professional like ourselves who are giving advice and handling more cases from Scottish companies who proactively look to help themselves.

The funny thing is it’s easy to get this advice – we offer a FREE initial consultation to anybody who wants one. All they have to do is get in touch and arrange one to suit them.

We’re happy to work with them and their accountants to help them come up with the best plan to meet their goals for the year or if they need to act quickly to shore themselves up financially and weather any immediate storms that might be upon them.