For the fifth year in a row, the corporate insolvency figures in January for Scotland have dipped.

Whether it’s first foots getting a running start on the year or the Hogmanay Hangover hovering around and stopping directors and business owners taking action – the trend is clear and continuing.

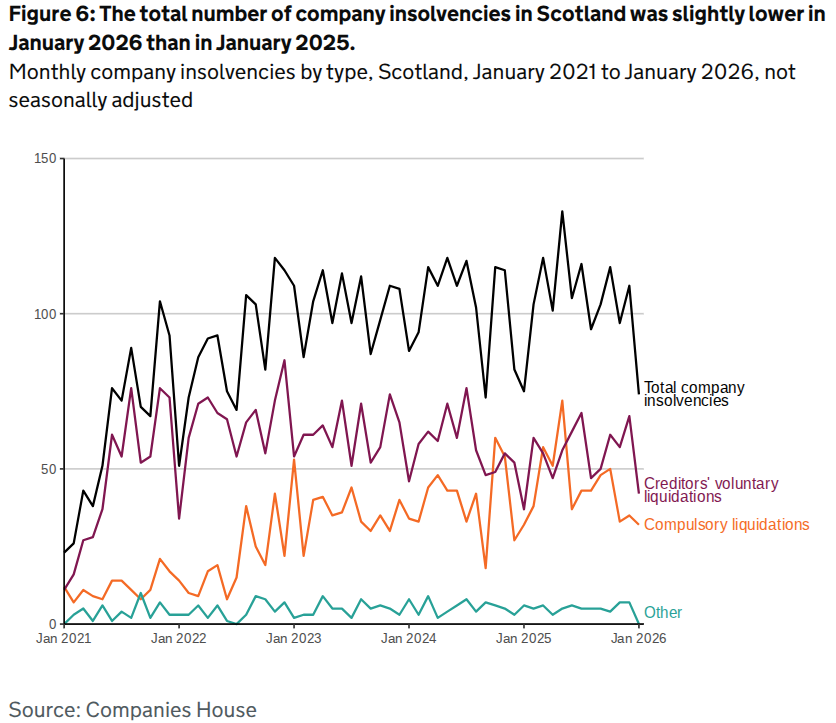

In January, there were 74 company insolvencies registered in Scotland which is only one fewer than the same month a year ago.

The total number of company insolvencies for January was 42 CVLs (down 27) and 32 compulsory liquidations (down three). There were no administrations, CVAs or receivership appointments.

It’s important to note that Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB) is Scotland’s insolvency service and administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26th 2020 and January 31st 2026, there were three restructuring plans and one moratorium in Scotland.

Scotland has always traditionally recorded more compulsory liquidations than any other kind of insolvency procedure but CVLs overtook them in April 2020 and typically remained higher until a three month period from March to June in 2025, when they retook the higher position.

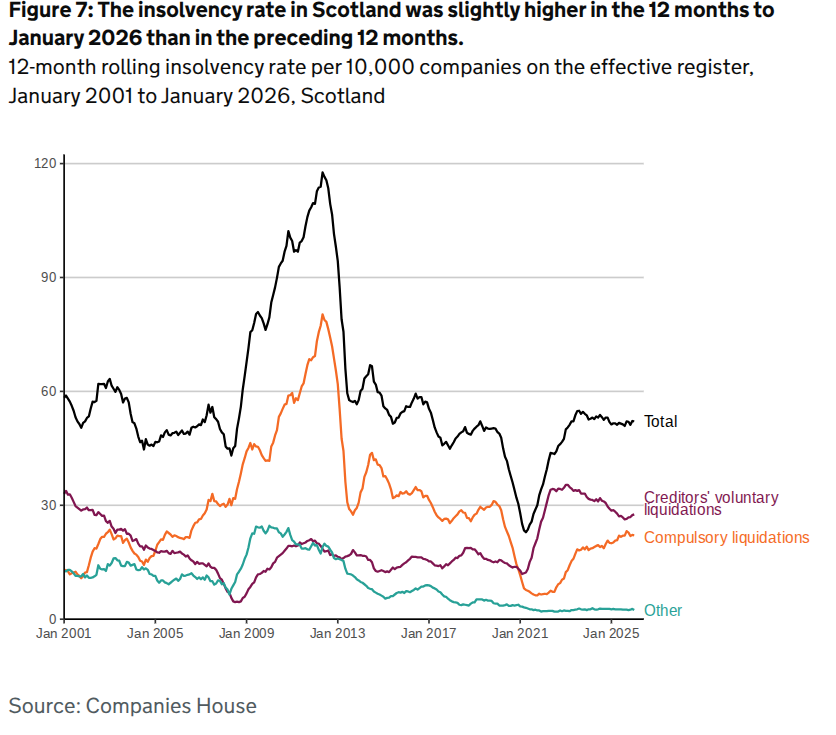

The total insolvency rate in Scotland in the 12 months to January 2026 was 52.1 per 10,000 companies on the effective register which was up by 0.8 from the preceding 12 months ending in January 2025.

The total number of company insolvencies for the whole of the UK in January 2026 was 1,839 – a month-on-month increase of 37.

Chris Horner, insolvency director with BusinessRescueExpert, said: “January was certainly a quieter month in Scotland for business insolvencies.

“Even granted that the first month of the year is traditionally a slow starter, the first month of 2026 was exceptional in this regard because the total is the lowest monthly total since January 2022.

“Voluntary liquidations were down by more than 50% on the previous month while compulsory liquidations more or less held up at the same level. There were no administrations or CVAs meaning that directors were happier to see their companies closed than look to give them valuable breathing space.

“This might be the correct course of action for some but it’s still an important and vital tool to help otherwise viable businesses that are being overlooked.”

Whether 2026 has got off to a slow or blistering start, there is still plenty of time for your business to get to where you want it to be.

Get in touch with us for a free initial consultation about the options you could have to help you create and work through a feasible plan and strategy no matter what your short and medium term goals for the year.

We’ll help you to implement them – the sooner you get in touch, the sooner we can begin.