Everything you need to know this month

The Insolvency Service have issued their latest corporate insolvency statistics for the month of July and they’ve bucked a trend – although not in the way we were hoping or expecting.

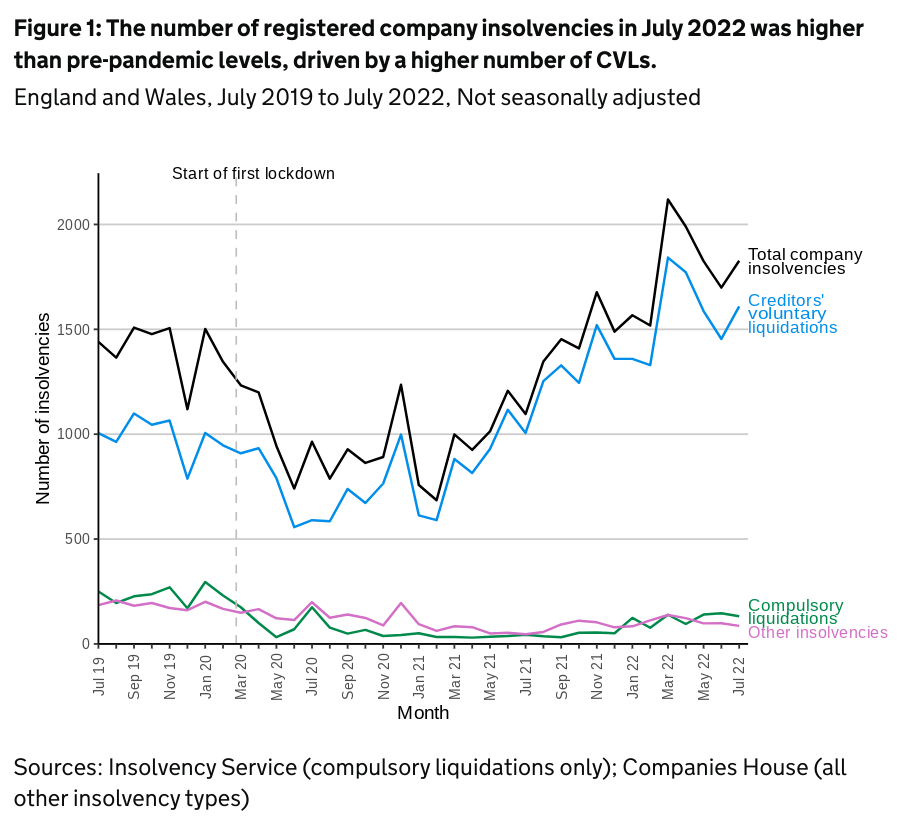

The tendency of corporate insolvency figures recently has been to spike one month, fall back the following month and then spike again.

We saw a large spike in June, however July has simply carried on the upward momentum.

The total number of company insolvencies in England and Wales alone for last month was 1,827.

This is 8% (136) higher than the total in June; 67% higher than in the same month last year (1,096) and 27% higher than the last pre-pandemic equivalent period (1,440) in July 2019.

This is the third highest monthly total recorded since January 2019 and it’s interesting that the only two higher totals – April and May 2022 have both been recorded this year.

The figure also marks the fifteenth consecutive month when the number of corporate insolvencies recorded was both over 1,000 and was higher than the corresponding monthly figure from a year previously.

Looking closer at the 1,827 company insolvencies more closely, the clear majority of cases is made up of Creditor Voluntary Liquidations (CVLs) with 1,609 – which makes up 88% of the recorded total – an increase of 2% on the previous month.

This is also a 60% increase in the number of CVLs than last June and 60% more than in June 2019.

There were a total of 132 compulsory liquidations including winding up petitions (down from 136 in June). There were 81 administrations (down from 90 last month) and 5 company voluntary arrangements (CVAs) which was down from 8 last month.

Compulsory liquidations might have dipped slightly month on month but are 200% higher than they were a year ago although they still remain 47% lower than the equivalent pre pandemic period of July 2019.

One reason for this is that creditors are continuing to take more aggressive actions to recover any outstanding debts by using statutory demands and winding up petitions to either force payment or the closure and liquidation of the business in order to receive some recompense.

Administrations were also down slightly on last month but they are double (103%) the total from a year ago, although 45% lower than in July 2019.

CVAs continue to remain low with 5 last month which is 17% lower than in June 2020 and 87% lower than they were in the same month in 2019. There were no receivership appointments last month either.

The reduction in administrations and CVAs further indicate the case that creditors and business owners are keener to liquidate companies rather than keep them alive although the reasons for this would be quite different.

There has been no change in the number of insolvency moratoriums obtained in England and Wales since their inception in June 2020 with 39 and a further 12 companies having their restructuring plans registered at Companies House.

Scotland

There were 70 company insolvencies recorded in July in Scotland this year. This is down slightly from the 76 registered in June and is a similar number to one recorded in July 2021 but 28% lower than the same period in 2019.

This was made up of 55 CVLs (down from 67 in June) and 15 compulsory liquidations (up from 8 last month). There were no administrations, CVAs or receivership appointments recorded.

No Scottish companies have registered an insolvency moratorium since June 2020 and two companies have registered their restructuring plans in the same period.

Scotland has traditionally seen higher compulsory liquidations as the reason for most liquidations but since April 2020 there have been more than three times as many CVLs recorded, with no sign of this trend being halted or reversed.

Northern Ireland

There were 14 company insolvencies registered in Northern Ireland in July which was down from the 26 recorded in June. This is the same total as the one recorded in July 2021 but 33% lower than the same period in 2019.

This total consisted of one compulsory liquidation, 10 CVLs and three administrations with no CVAs or receivership appointments recorded.

The total number of UK company insolvencies for July 2022 is 1,911 which is an increase of 118 on the June total of 1,793 although slightly less than the 1,930 recorded in May.

Christina Fitzgerald, President of R3, the insolvency and restructuring trade body, said:

“The increase in corporate insolvencies is being driven by a rise in Creditors’ Voluntary Liquidations (CVLs), which were 59.9% higher than this time last year, and 60.1% higher than pre-pandemic levels in 2019.

“This suggests that a growing number of company directors are choosing to close their businesses, perhaps because they believe that the current economic conditions make survival impossible.

“In recent months, economic pressures have been hitting firms from every angle. Inflation remains high and the economy is shrinking, with GDP estimated to have falled by 0.1% in Q2 of this year and by 0.6% in June, undoing the small boost to the economy we experienced in May.

“Despite an unexpected rise in consumer confidence last month, people are still being cautious with how they spend their money, meaning many businesses are struggling to bring in the revenue they need to offset spiralling costs.

“Coupled with this, the number of open job vacancies has continued to grow since the pandemic, while July saw the slowest increase in the number of permanent jobs filled for 17 months.

“This ongoing labour shortage remains a concern for many small firms that may not be able to afford to raise wages to attract the workers they need to operate at full capacity.

“Things are only set to get harder this year, so it is more important than ever that anyone running a business knows where to go to seek advice about their finances. Taking advantage of a free initial consultation to help business owners better understand their position and outline the potential options available should issues arise.”

Most people spend the summer looking for a bit of downtime, a sense of switching off, resetting and recharging the batteries while it’s quiet for a busier autumn and winter period before Christmas.

Unfortunately if you’re a business owner or director, you might not have this luxury if you’re trying to meet all your financial obligations on time and run the business to the best of your ability.

With inflation reaching double figures for the first time since the early 1980s and with company energy bills about to head for the stratosphere without the protection of the domestic household price cap – this summer might instead be the time to work out how the business will survive into the new year and beyond.

This is where we can help.

They will then run through the available options they can take both in the short and medium term to initially improve things and build momentum for the future.

While things might improve, we can all testify that they can also get worse and probably quicker than we anticipate too so taking the opportunity to make changes, while we still can is possibly the easiest decision you could make all summer.