Administrations at their highest levels for 18 months

The back-to-work blues and “Blue Monday” vibes seeped into the wider economy in January in the latest corporate insolvency figures for January 2026, released by The Insolvency Service this week.

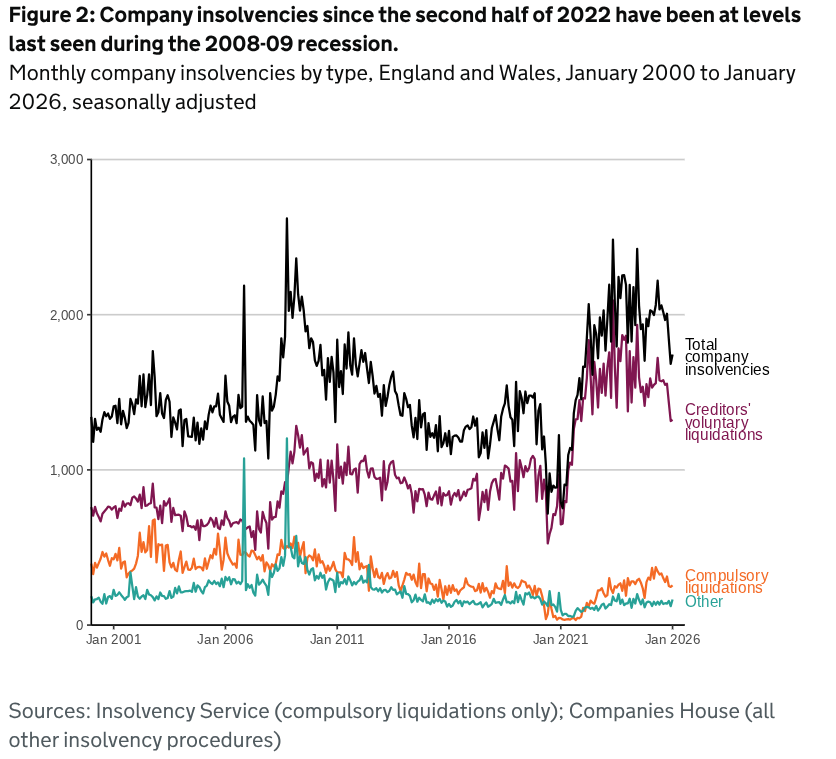

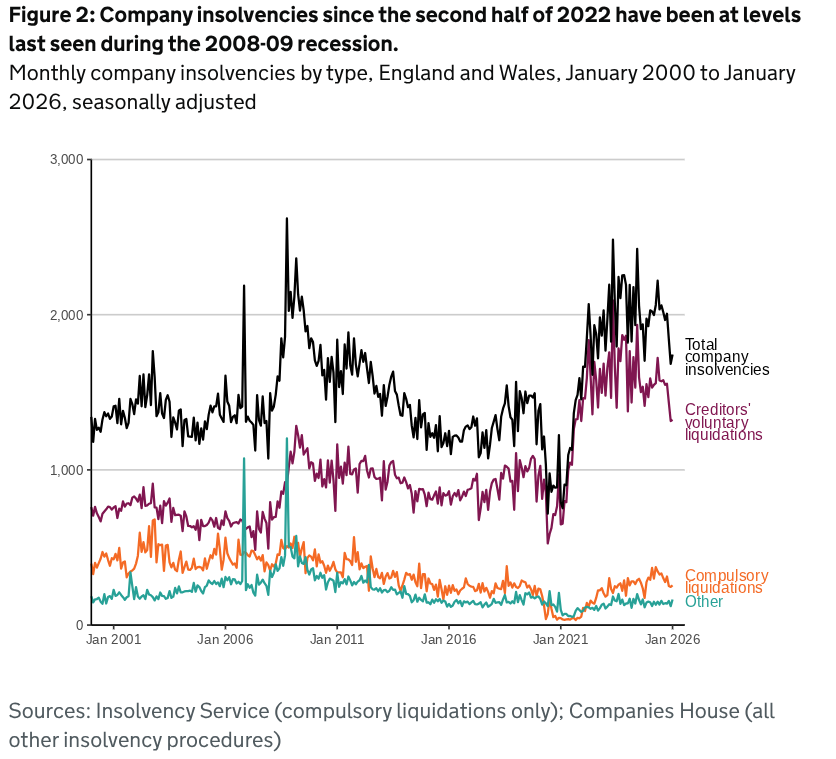

There were a total of 1,744 registered company insolvencies recorded last month, which was 4% higher than in December 2025 (1,683) but 14% lower than the same month a year ago (2,028).

Analysis

Of the 1,744 corporate insolvencies in January, the most frequent kind remains Creditors’ Voluntary Liquidations (CVLs) with 1,323 – a historically low monthly number and only 18 (1%) higher than the previous month’s total, which was the lowest monthly total of CVLs seen since August 2021.

Although it was slightly higher than December’s total, it’s 17% lower than in January 2025.

CVLs accounted for 76% of all company insolvencies last month, 2% fewer than the previous month.

In 2025 CVL volumes decreased slightly by 2% from 2024 and by 10% from the record-high numbers registered in 2023. The past four years have seen the highest numbers of CVLs since recording began in 1960. Between 2017 and 2019, CVLs had been rising at approximately 10% a year but fell during the pandemic period to their lowest totals since 2007.

There were a total of 256 compulsory liquidations in January which was 4% higher than last month but 12% lower than a year ago. Compulsory liquidations were 15% lower than their 2025 monthly average.

Last year, compulsory liquidations were at their highest levels since 2012, increasing by 15% annually. This is a sharp increase from their record low levels in 2020 and 2021 when the government applied restrictions on the use of statutory demands and winding-up petitions to stop creditors taking action against companies.

HMRC are continuing to target companies with outstanding Corporation Tax, VAT, PAYE or National Insurance contributions (NICs) arrears in 2026. They are recruiting more agents and receiving more funding for investigations to claw back as much as possible.

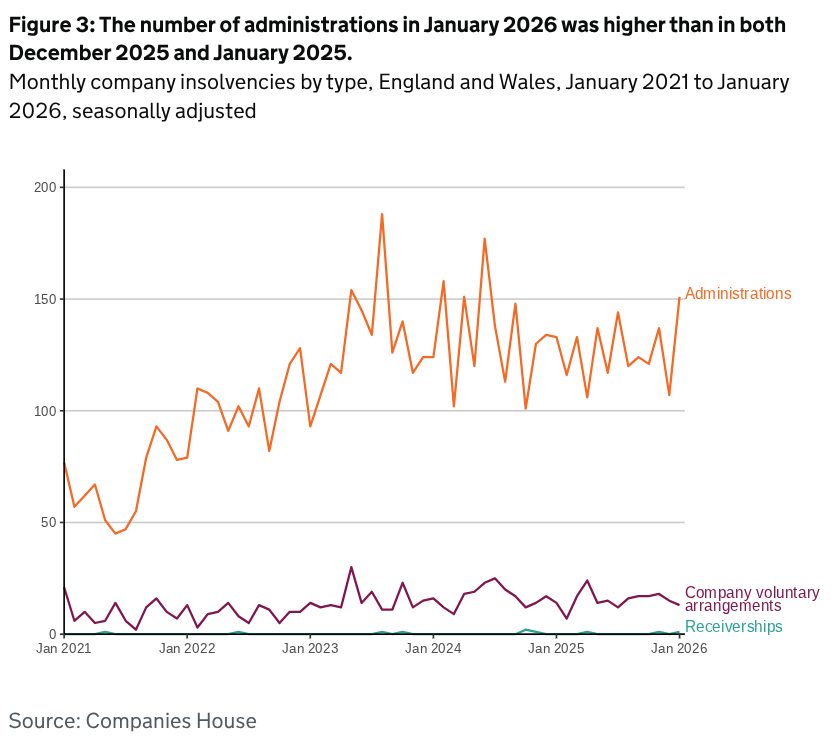

There were 151 administrations in January 2026 which was 41% higher than in December 2025 and 14% higher than the same month a year previously. It’s also the highest monthly number of administrations for 18 months.

In 2025, the number of administrations decreased by 8% from 2024. This followed a sustained increase between 2022 and 2024 after the 18-year annual low seen during the pandemic affected 2021.

There were 13 Company Voluntary Arrangements (CVAs) in January which was 13% lower than the previous month and 7% lower than in January 2025. These numbers remain low compared to historical levels.

CVAs were lower in 2025 than in 2024 but similar to 2023. Overall the number of CVAs last year was 47% lower than the annual average from 2015 to 2019.

There was one receivership appointment in January 2026 which is notable as only three were registered in the whole of 2025.

There were no moratoriums or restructuring plans registered at Companies House in January 2026. Between June 26th 2020 and January 31st 2026, 61 companies obtained a moratorium and 37 companies had their plans registered at Companies House. Both procedures were created by the Corporate Insolvency and Governance Act 2020.

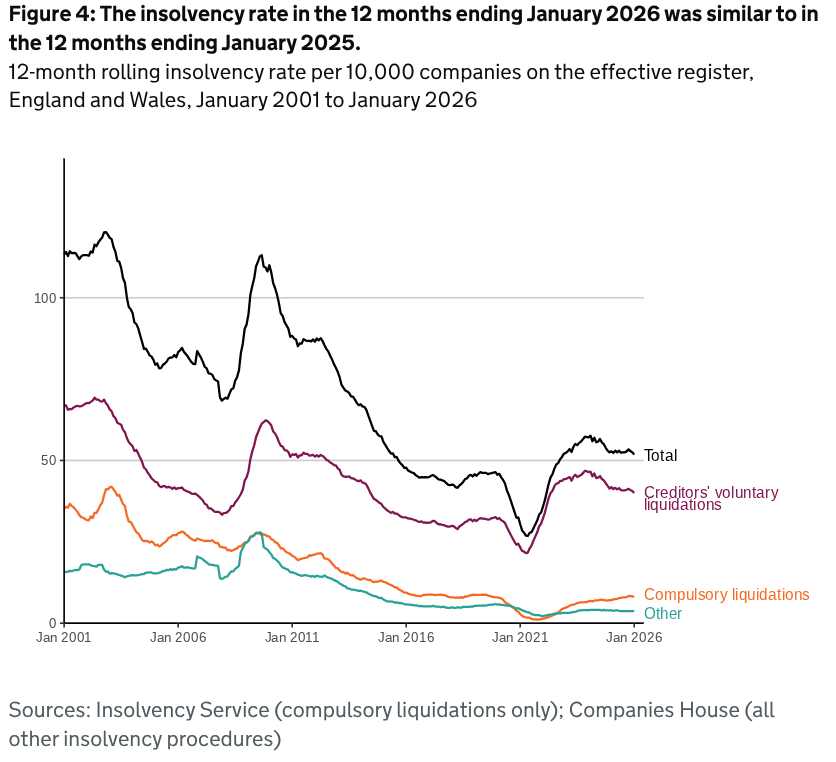

The rolling company liquidation rate in the 12 months to January 2026 was 51.7 per 10,000 companies on the effective register in England and Wales which corresponds to one in 193 companies entering insolvency.

This is an increase from 52.5 per 10,000 last month or one in 190.

These rolling rates are calculated as a proportion of the total number of companies on the effective register and are more comparable over longer time periods than the absolute numbers. A 12-month rolling rate is presented to reduce the volatility associated with estimates based on single months.

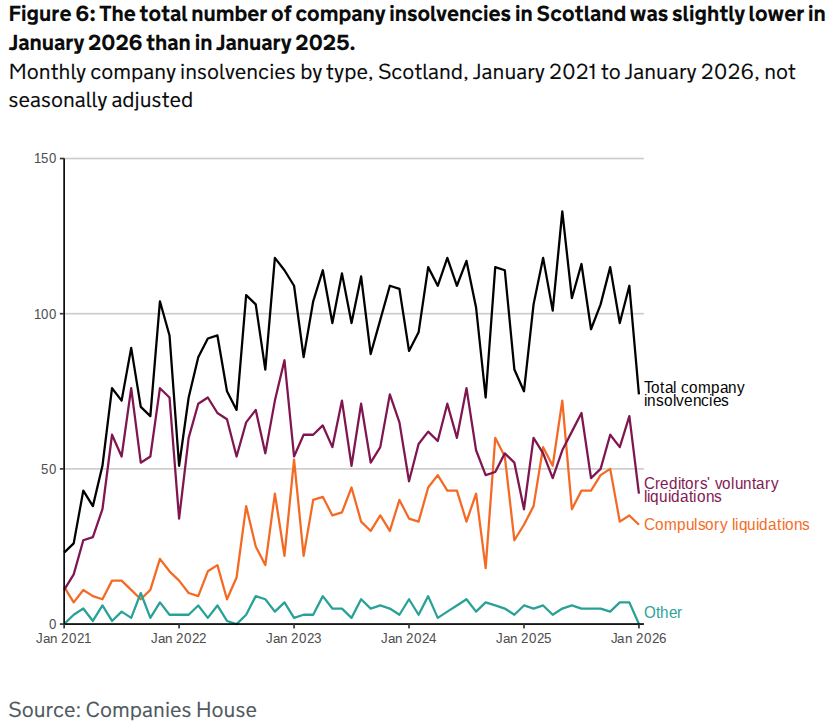

Scotland

In January there were 74 company insolvencies registered in Scotland which is only one fewer than the same month a year ago.

The total number of company insolvencies for January was 42 CVLs (down 27) and 32 compulsory liquidations (down three). There were no administrations, CVAs or receivership appointments.

It’s important to note that Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB) is Scotland’s insolvency service and administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26th 2020 and January 31st 2026, there were three restructuring plans and one moratorium in Scotland.

Scotland has always traditionally recorded more compulsory liquidations than any other kind of insolvency procedure but CVLs overtook them in April 2020 and typically remained higher until a three month period from March to June in 2025, when they retook the higher position.

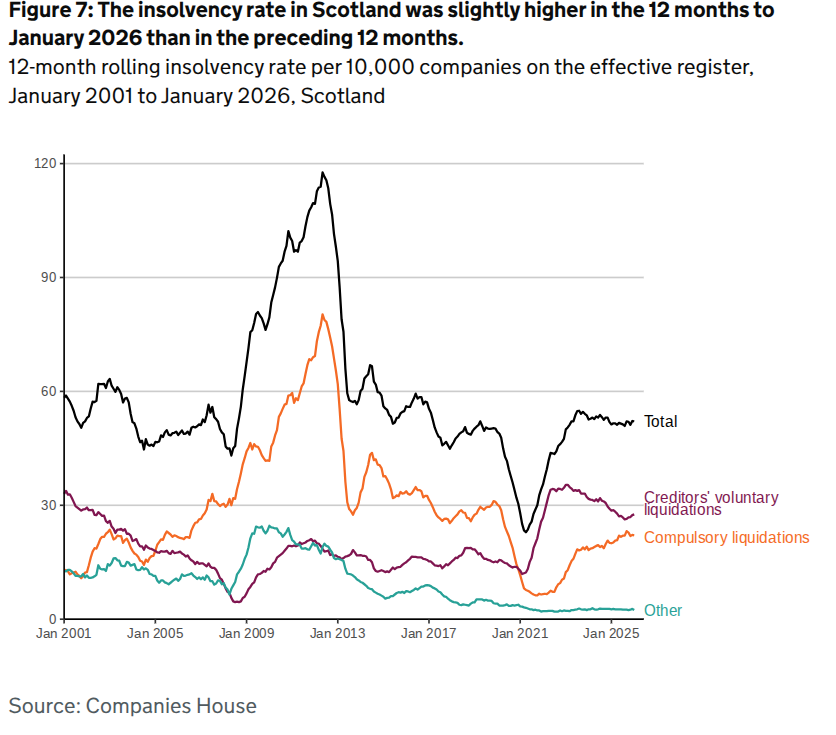

The total insolvency rate in Scotland in the 12 months to January 2026 was 52.1 per 10,000 companies on the effective register which was up by 0.8 from the preceding 12 months ending in January 2025.

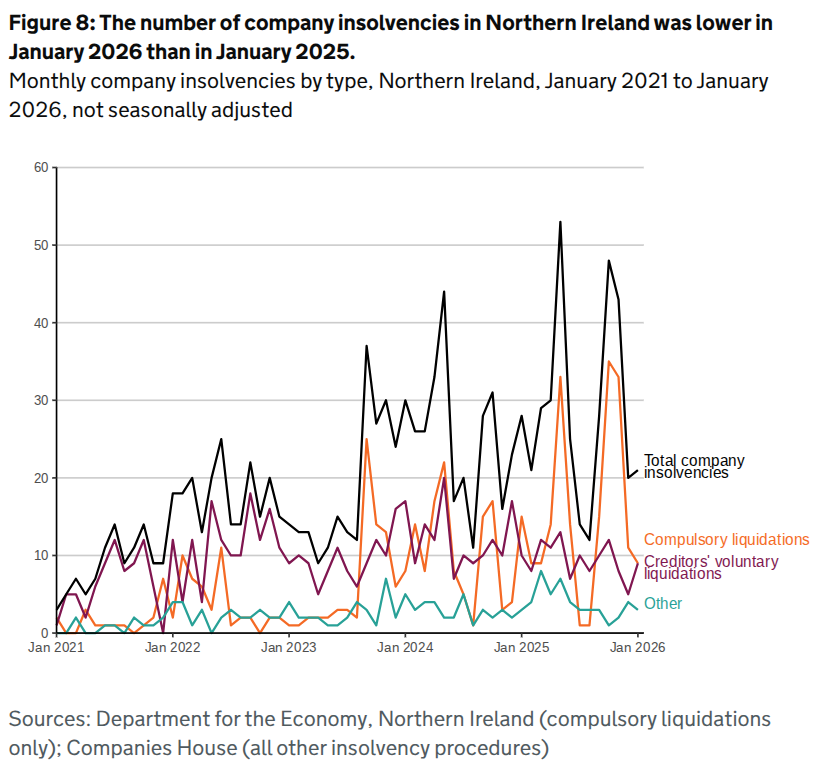

Northern Ireland

In January there were 21 company insolvencies registered in Northern Ireland, which was 25% lower than the same month a year previously.

The total number of company insolvencies in the province was nine compulsory liquidations (down from 11); nine CVLs (up from five); one CVA (down from four) and two administrations (up from zero). There were no receivership appointments.

Between June 26th 2020 and January 31st 2026, there was one moratorium in Northern Ireland and no restructuring plans.

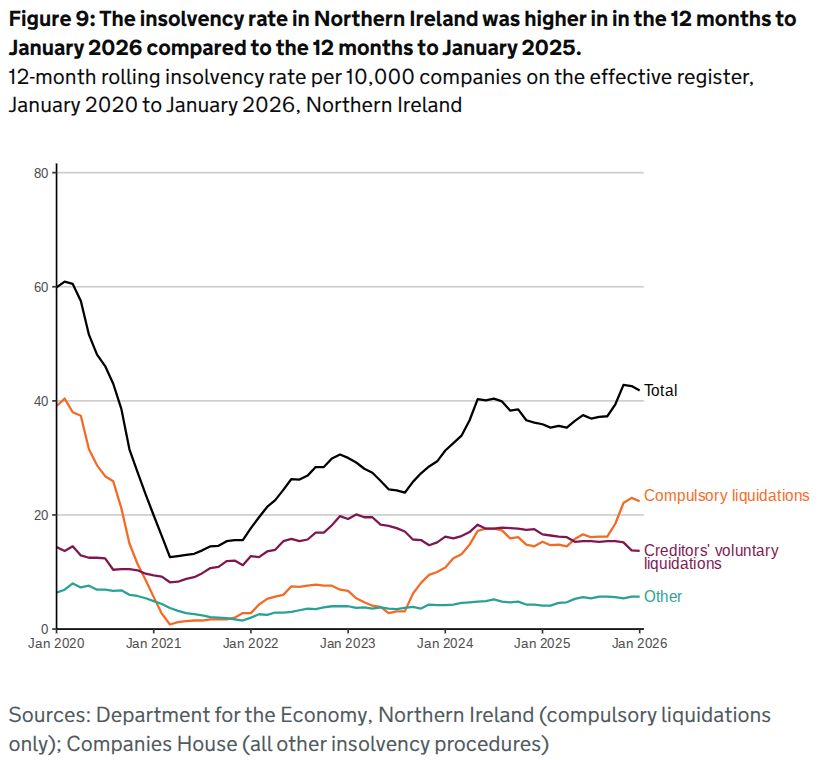

The total insolvency rate in the 12 months to January 2026 in Northern Ireland was 41.8 per 10,000 companies on the effective register. This is an increase of 5.9 from the rate of 35.9 per 10,000 companies seen in the 12 months to January 2025.

The total number of company insolvencies for the whole of the UK in January 2026 was 1,839 – a month-on-month increase of 37.

Tom Russell, president of R3, the UK’s restructuring, turnaround and insolvency trade body, said: “January is often a tough month financially for businesses and households alike and the insolvency figures reflect the dismal, rain-soaked start to the year the UK has endured.

“However, there is a ray of sunshine with corporate insolvencies 14% lower than the same month a year ago.

“Businesses across several sectors haven’t had the results from the “Golden Quarter” boost they’d hoped for. As a result, January has slightly become a tipping point, where high costs, disappointing sales and year-end financial pressures converge.

“Although the latest GDP figures show 0.1% growth for December and 1.3% growth for 2025, forecasts point to continued slow growth and subdued business confidence this year. Construction, meanwhile, recorded its worst performance in more than four years reinforcing the findings of R3’s Annual Business Health Report which identified it as the most distressed sector in 2025.

“Small and medium sized businesses are particularly exposed to cashflow pressures and late payments, with construction firms especially affected.

“A recent report by the Business and Trade Committee found SMEs are owed tens of billions of pounds in unpaid invoices, with nearly half of all invoices paid late. It also noted that late payments are responsible for the closure of 38 UK businesses every day, a trend reflected in today’s figures.”

Whether 2026 has got off to a slow or blistering start, there is still plenty of time for your business to get to where you want it to be.

Get in touch with us for a free initial consultation about the options you could have to help you create and work through a feasible plan and strategy no matter what your short and medium term goals for the year.

We’ll help you to implement them – the sooner you get in touch, the sooner we can begin.