What else do the Q1 2023 statistics reveal?

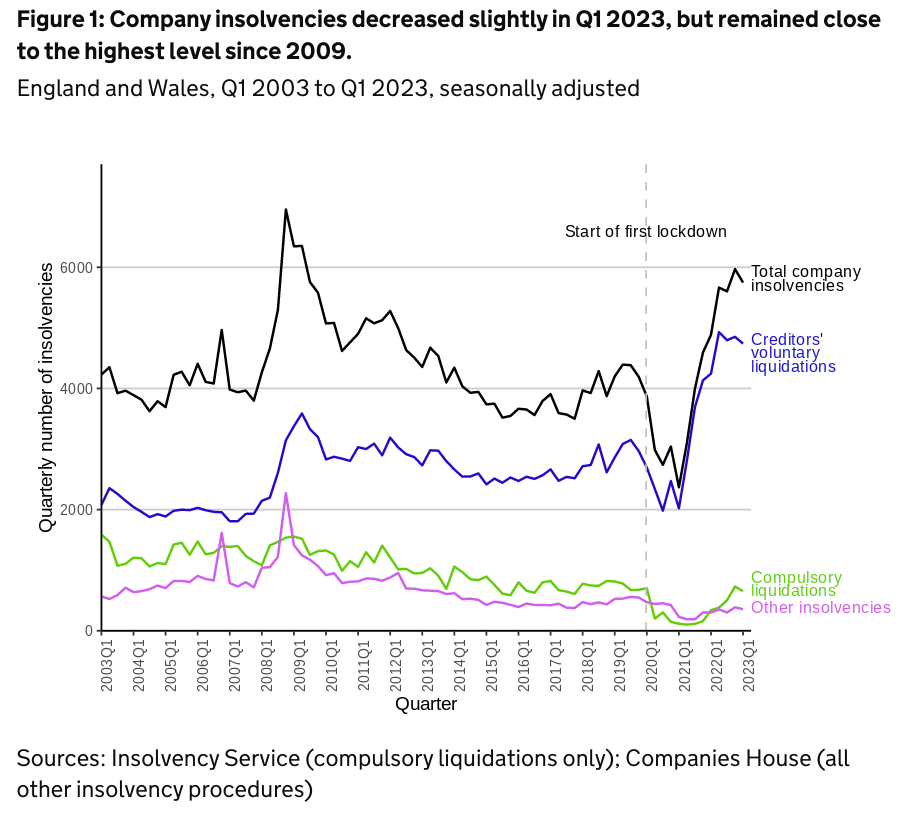

2023 is shaping up to be a trickier year for many small and medium sized businesses than their owners or directors would have expected and the recently announced corporate insolvency figures for the first quarter of the year seem to bear this out.

Between January 1st and March 31st 2023 there were a total of 5,747 company insolvencies in England and Wales which comprised:-

- 4,739 Creditors Voluntary Liquidations (CVLs)

- 652 Compulsory Liquidations

- 318 Administrations

- 38 Company Voluntary Arrangements (CVAs)

- 0 Receivership Appointments

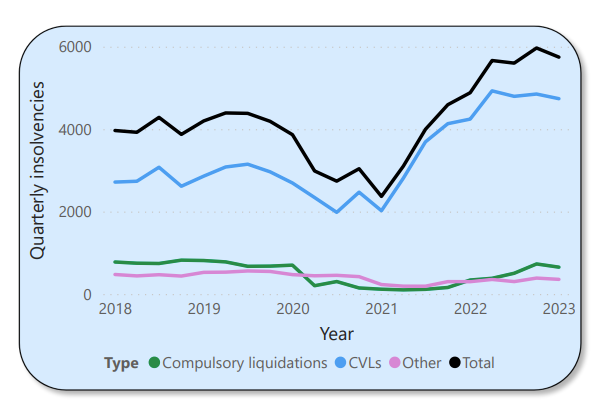

Overall the total number of insolvencies was 4% lower than the last quarter of 2022 but were 18% higher than in the corresponding Q1 of 2022.

Analysis

Creditors Voluntary Liquidations (CVLs)

The 4,739 Creditors Voluntary Liquidations accounted for 82% of all company insolvencies in the first three months of 2023.

This is 2% lower than the preceding quarter in 2022 but 12% higher than Q1 2022.

Taken as an annual total there were a total of 17,234 CVLs in 2022 which was the highest cumulative four quarters total recorded since the statistics began in 1960.

Compulsory Liquidations

The 652 Compulsory Liquidations were 11% lower than the previous quarter but 92% higher than Q1 2022.

During the pandemic, they were at record low levels because they were artificially restricted. No creditor was allowed to issue statutory demands or seek winding up petitions during the pandemic but these have now been active for more than a year which has seen numbers rise substantially but are still below their pre-pandemic number for the time being.

Administrations

There were 318 administrations recorded in the first three months of 2023 which was 12% lower than the previous three months but is 16% higher than the same period in 2022.

Unlike other insolvency procedures, administrations did not drop at the start of the pandemic in Q2 2020 but they did reduce significantly in 2021 to their lowest levels since 2003 before recovering in 2022.

Creditor Voluntary Arrangements (CVAs)

There were 38 creditor voluntary arrangements (CVAs) finalised in the first three months of the year. Although this number is low compared to historical levels, it is 52% higher than both the previous and corresponding quarters in 2022.

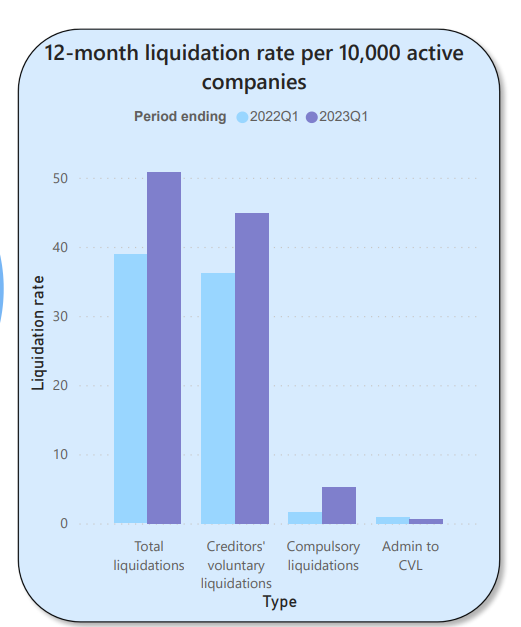

Liquidation rates per 10,000 companies

It can be confusing to get an accurate view of what’s happening with company liquidations judging purely by headline figures because one-off events can influence them and make them look more or less than they are, depending on the circumstances.

One way of looking at the situation on a more granular level is to see how many businesses are being liquidated for every 10,000 that are open and operating normally. Insolvency rates are calculated as a proportion of the total number of active companies are more comparable over longer time periods than the absolute numbers.

In the four quarters that ended at Q1 2023, the company liquidation rate was 50.8 per 10,000 active companies in England or Wales which corresponds to 1 in 197 entering liquidation in the previous 12 months.

| Quarter | Total Liquidations | Compulsory Liquidations | CVLs | CVL following Administration |

| 2022 Q1 | 38.9 | 1.7 | 36.3 | 0.9 |

| 2022 Q2 | 43.9 | 2.4 | 40.7 | 0.8 |

| 2022 Q3 | 46.9 | 3.3 | 43.0 | 0.7 |

| 2022 Q4 | 49.5 | 4.6 | 44.3 | 0.6 |

| 2023 Q1 | 50.8 | 5.3 | 44.9 | 0.6 |

We can see a steady rise in the number of liquidations per 10,00 companies with the biggest rise being CVLs but also a rise in compulsory liquidations which means that the return of statutory demands and winding up petitions is having an effect.

The number of CVLs following an administration has fallen which indicates that more directors aren’t pursuing the option of an administration to sell or restructure their businesses and are closing them through a CVL instead.

Change in rate per 10,000 active companies for 12 months ending in Q1 2023

| Quarter | Total Liquidations | Compulsory Liquidations | CVLs | CVL following Administration |

| V 2022 Q4 | 1.3 | 0.7 | 0.6 | 0.0 |

| V 2022 Q1 | 11.9 | 3.6 | 8.6 | -0.3 |

These rates show that while total liquidations have risen over the past three months, they have grown even more from a year ago. The number of CVLs following an administration has actually decreased.

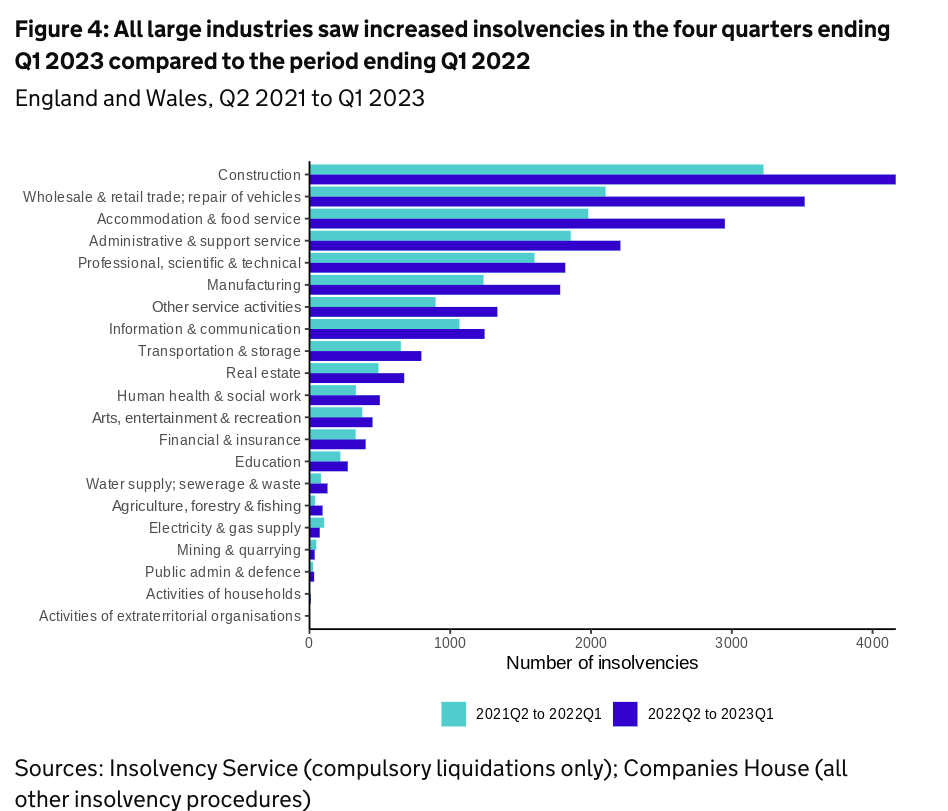

Individual industrial sector focus

| Sector | Number of insolvencies | Percentage of all cases |

| Construction | 4,165 | 19% |

| Retail | 3,518 | 16% |

| Hospitality | 2,951 | 13% |

| Administration | 2,209 | 10% |

| Professional, Technical & Scientific activities | 1,817 | 8% |

The five sectors with the most insolvencies are construction, retail, hospitality (accommodation and food service), administration services and professional, technical & scientific activities.

These five remain the same sectors with the highest number of insolvencies from 12 months ago but the number of companies within these sectors going into insolvency has also increased more than any other sector although including manufacturing saw the third highest increase within a specific sector.

“Many choosing to close their own terms before the choice is taken away”

Chris Horner, insolvency director with BusinessRescueExpert said: “There’s a lot to pick through the latest statistics but some strong themes emerge immediately.

“Administrations finally rising above their pre-pandemic average isn’t that surprising. The rise in energy prices, interest rates, inflation and the conclusion of government business support is putting increased pressure on businesses.

“While some are using the administration process wisely to explore all options available to restructure or rescue their company, it’s telling that increasingly more are closing their businesses through a creditors voluntary liquidation (CVL) procedure.

“A CVL means that all unsecured debts including bounce back loans are written off allowing directors to move onto their next professional venture or start a new business without arrears hanging over them and dragging the business down.

“Business owners have spent three years trading through a pandemic and ongoing economic uncertainty, so it’s no surprise that more are choosing to close their business on their own terms before the choice is taken away from them and the turbulent trading climate gets worse and overwhelms them.

“We’re nearly halfway through 2023 and the short term looks increasingly bumpy for many businesses. Energy bills remain high, disproportionately affecting restaurants and pubs. Add in inflation still in double figures, higher interest rates that might even be rising again this month and a more aggressive, less forgiving HMRC looking to actively chase outstanding tax arrears and an insolvency procedure looks more attractive by the day for a tuned-in director to consider.”

This is why we offer a free initial consultation for any director or business owner who wants to know exactly what options they have.

If they want to restructure and strengthen their business or if they decide that their interests would be better served through an efficient and effective closure, our expert advisors will be able to work through all the scenarios with them and let them decide which direction they want to move in.

All they have to do first is take the easiest step and get in touch today.