What else do August’s insolvency statistics reveal?

The Insolvency Service have issued their latest corporate insolvency statistics for the month of August and the end of summer has brought another spike in the numbers.

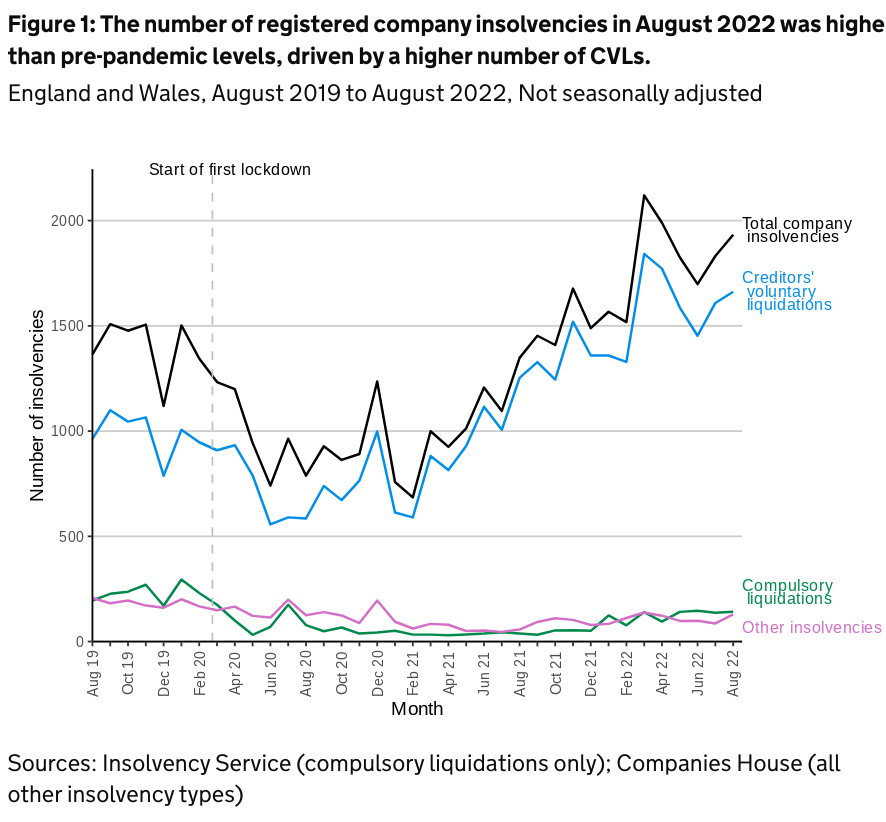

The total of 1,933 company insolvencies in England and Wales last month was the third highest in 2022 already and the third highest in total since January 2019.

This is 5.5% (101) higher than the total recorded in July; 43% higher than the same month last year (1,348) and 42% higher than the last pre-pandemic equivalent period (1,365) in August 2019.

To give added context, the figure of 1,933 marks the sixteenth consecutive month when the number of corporate insolvencies recorded was both over 1,000 and was higher than the corresponding monthly figure from a year previously.

If we take a closer look at these 1,933 company insolvencies more closely, Creditor Voluntary Liquidations (CVLs) remain the clear majority of cases with 1,662 – which makes up 86% of the total amount.

This sees an increase of 33% on the number of CVLs processed last August and 73% more than the pre pandemic August 2019.

There were also a total of 142 compulsory liquidations that also included winding up petitions (up 5 from July). Additionally there were 116 administrations (up 35 from last month) and 13 company voluntary arrangements (CVAs) which was also up from 8 last month.

There are some big yearly increases on last August’s monthly figures.

Compulsory liquidations are up 274% on last year’s August figure although down by 27% on the figures from August 2019. This is a sign that creditors are continuing to take more aggressive actions to recover any outstanding debts by using instruments such as statutory demands and winding up petitions that will either enforce payment or ultimately the closure and liquidation of the business in order to try and secure some repayment.

Administrations also rose by more than 25% month on month and up 111% annually although also down 34% in August 2019.

CVAs continue to remain low by historical standards, down 57% on pre-pandemic August 2019 but have risen 550% in a month which might indicate a recovery. There were no receivership appointments last month.

We continue to see the rise in liquidations compared to administrations and CVAs as further evidence that creditors are continuing their aggressive approach by looking to close companies down and liquidate their assets rather than have them remain alive and restructured.

Between June 26 2020 and August 31 2022, there have been 40 moratoriums obtained in England & Wales and a further 12 companies having their restructuring plan registered at Companies House.

Scotland

There were a total of 105 company insolvencies recorded in August in Scotland this year. This is up 33% from the 70 recorded in July. They are also up 18% on the same month a year ago and up 33% from August 2019.

This was made up of 65 CVLs (up from 55 in July); 37 compulsory liquidations (up from 15 last month) and 3 administrations (0 in July). There were no CVAs or receivership appointments recorded.

No Scottish company has registered an insolvency moratorium since June 2020 but two have registered their restructuring plans over the same period.

Traditionally, Scotland has had higher compulsory liquidations than any other kind of insolvency but since April 2020, CVLs have been the highest by more than three times as many recorded.

Northern Ireland

There were a total of 14 company insolvencies in Northern Ireland in August – the same number as recorded in July.

This is 56% higher than a year previously but down 36% in the same month in 2019.

The overall number consisted of two compulsory liquidations, 10 CVLs, one administration and one CVA. There were no receivership appointments.

The total number of UK company insolvencies for August 2022 is 2,052, which is an increase of 141 on the July total and up 259 on June.

Christina Fitzgerald, President of R3, the insolvency and restructuring trade body, said:

“The monthly increase in corporate insolvencies – to the third highest set of monthly statistics since January 2019 – has mainly been caused by an increase in the number of Creditors’ Voluntary Liquidations.

“This suggests that directors remain concerned about their ability to continue to trade in the current climate, and are choosing to close their businesses before that choice is taken away from them.

“These figures will be a sobering reminder to the government of the scale of the challenge facing the UK economy as we head into the winter months, and reflect the continued toll the sustained economic turbulence is taking on businesses in England and Wales.

“Companies are facing enormous running cost hikes just as household spending is facing its biggest squeeze in several decades which delivers yet another blow to business owners who were hoping to bounce back to normal trading levels post-pandemic.

“Many directors and managers are worried about the rise in prices and energy costs and the effect these will have on their margins and profits, and this is set to continue to be a concern.”

August’s figures come at the beginning of a potentially pivotal week for most businesses.

More details of promised business energy bill support will be announced, a postponed decision on interest rate levels will be made public following a meeting by the Bank of England monetary policy committee on Thursday and Friday will see the new Chancellor of the Exchequer Kwasi Kwarteng deliver a “mini” budget revealing more economic measures and policy announcements over the next six months and beyond.

There will be days of headlines, both positive and negative, before analysts dig deeper over the weekend and the real probable outcomes are revealed in the following week.

But if you’re running a business that is having to manage rising bills in every direction right now, then you don’t have the luxury of waiting to make a decision as time is already running out.

One of our experts will listen to them explain their company’s individual situation then let them know what realistic choices they have and what they can achieve.

Some businesses will be able to survive and hopefully thrive after using processes such as administration or a CVA to obtain the time to make necessary structural changes which will leave the business in a far healthier position than before.

Others might realise that they are coming to the end of this stage of their journey and that closing the business with a minimum of fuss and stress through a CVL or other liquidation process will be the logical way to proceed.

No matter what they decide, our experts will be able to advise and help them at every stage but only if they take the most difficult step and get in touch with us first.