October saw liquidations and administrations rising too

The latest corporate insolvency figures for October have been released by The Insolvency Service and they continue to rise across nearly all categories – individually and overall.

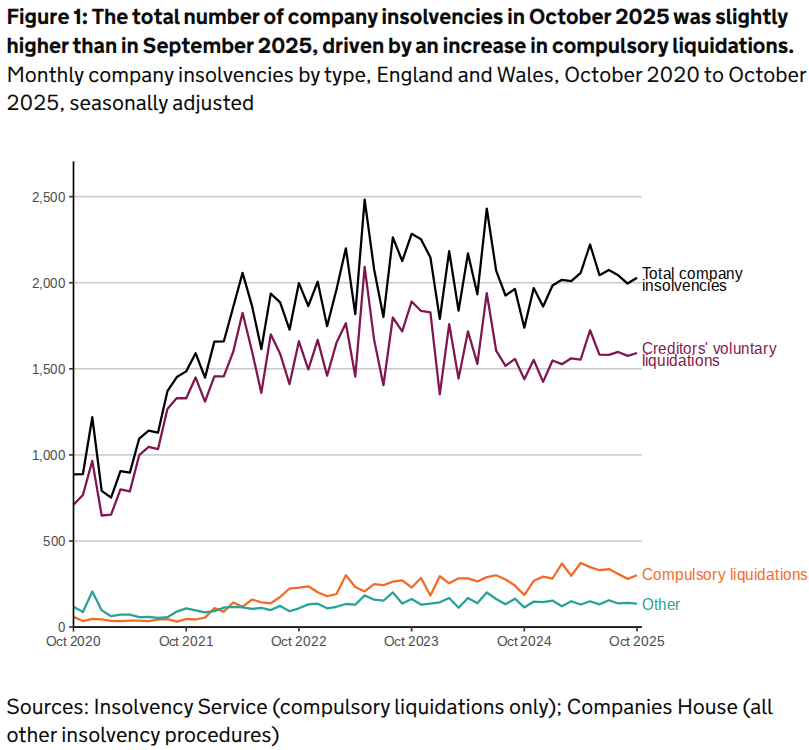

There were a total of 2,029 business insolvencies in England and Wales last month. This was an increase of 2% on the previous month’s total of 1,995 and was 17% higher than the total recorded in October 2024.

Analysis

Of the 2,029 corporate insolvencies recorded in October, the most frequent type remains Creditors’ Voluntary Liquidations (CVLs) with 1,592.

This was an increase of 17 cases from September’s total (1%) but is 11% higher than the same month from a year ago.

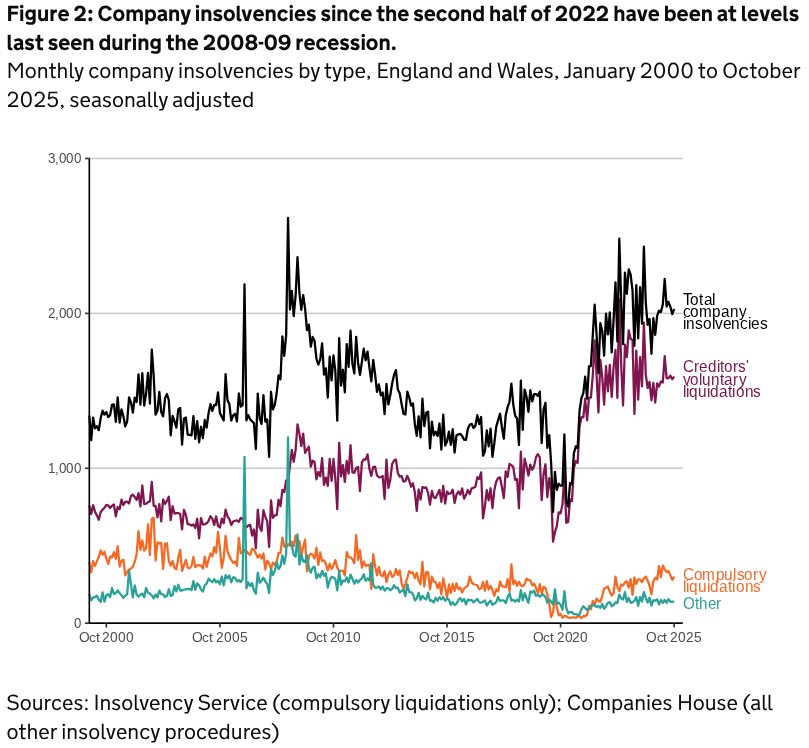

CVLs made up 78% of all corporate insolvencies recorded in October, a 1% decrease from the previous month. Contextually, the annual number of CVLs declined last year for the first time in four years after three consecutive years of increases – peaking in 2023 at their highest annual level since recording began in 1960. CVLs had been rising at approximately 10% a year but during the pandemic they fell to their lowest levels in 2007.

There were a total of 301 compulsory liquidations recorded in October. This was an 8% increase in the number of cases from last month and a 62% on the total from the same month a year earlier.

In 2024, compulsory liquidations were at their highest levels for ten years, having increased by 14% compared to 2023 volumes. This continued an increase from record low levels seen in 2020 and 2021 while restrictions applied to the use of statutory demands and certain winding up petitions (leading to compulsory liquidations). Numbers have increased further so far in 2025.

HMRC continues targeting companies with outstanding areas such as Corporation Tax, VAT, PAYE and National Insurance Contributions (NICs), with them increasing resources being allocated to investigations and recovery.

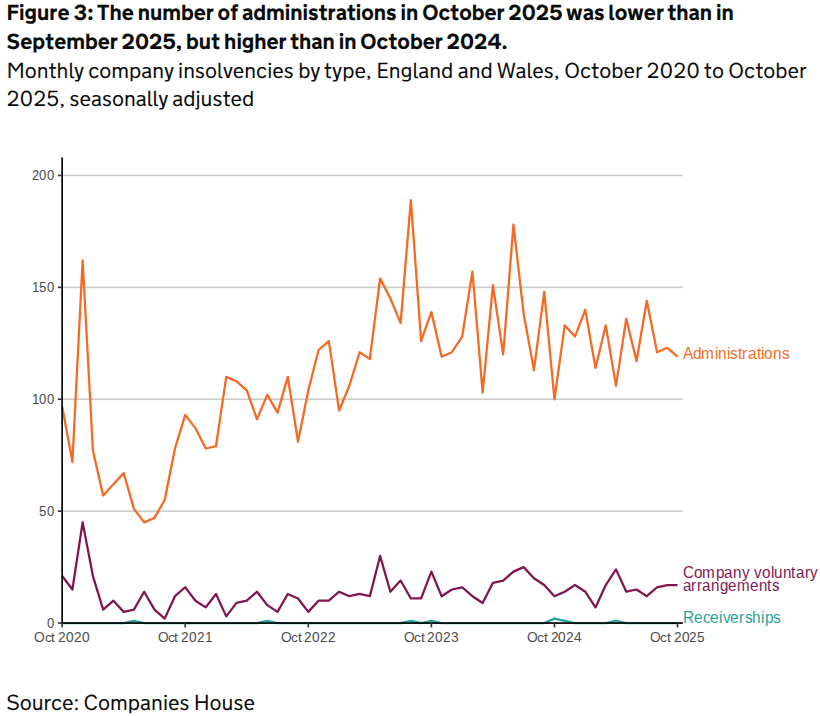

There were 119 administrations in October, which was 3% lower than September’s total but is 19% higher than the total from October 2024.

The number of administrations increased annually by 2% in 2024 and were slightly higher than the annual totals seen between 2015 and 2019. The number of administrations have been increasing since 2022 from an 18-year-old low seen during the pandemic in 2021.

There were 17 Company Voluntary Arrangements (CVAs) in October which was the same total as last month but a 42% increase from a year previously.

The number of CVAs in October 2025 was the same as in September 2025 and 42% higher than in October 2024. Numbers remain low compared to historical levels. CVAs are not seasonally adjusted due to low volumes.

CVAs numbers have remained relatively low compared to historic trends but increased by 9% from last year from 2023. They’ve increased by 58% from 2022 which saw their lowest ever total since the series began recording in 1993. Despite these rises, the annual total for 2024 was slightly less than the 2015 to 2019 average of 55%.

There were no receivership appointments in October with only two being registered in the previous 12 months to October 2024. One moratorium was registered with Companies House with no restructuring plans.

Since June 2020, 65 companies have obtained insolvency moratoriums that enable them to pause legal action from creditors while they restructure financially while a further 55 had their plans registered at Companies House as required under the Corporate Insolvency and Governance Act 2020.

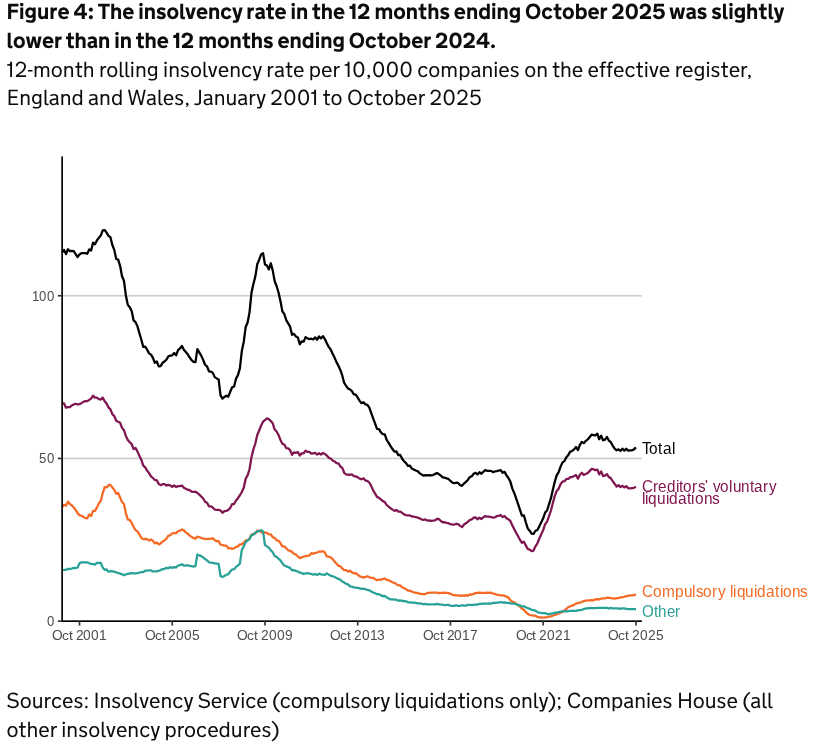

The rolling company liquidation rate in the 12 months to October 2025 was 53.4 per 10,000 companies which is equivalent to one in 187 companies entering insolvency. This is a slight increase from last month (52.9 or one in 189).

Rolling insolvency rates are calculated as a proportion of the total number of companies on the effective register and are more comparable over a longer period of time than absolute numbers which can be prone to short-term fluctuations.

Scotland

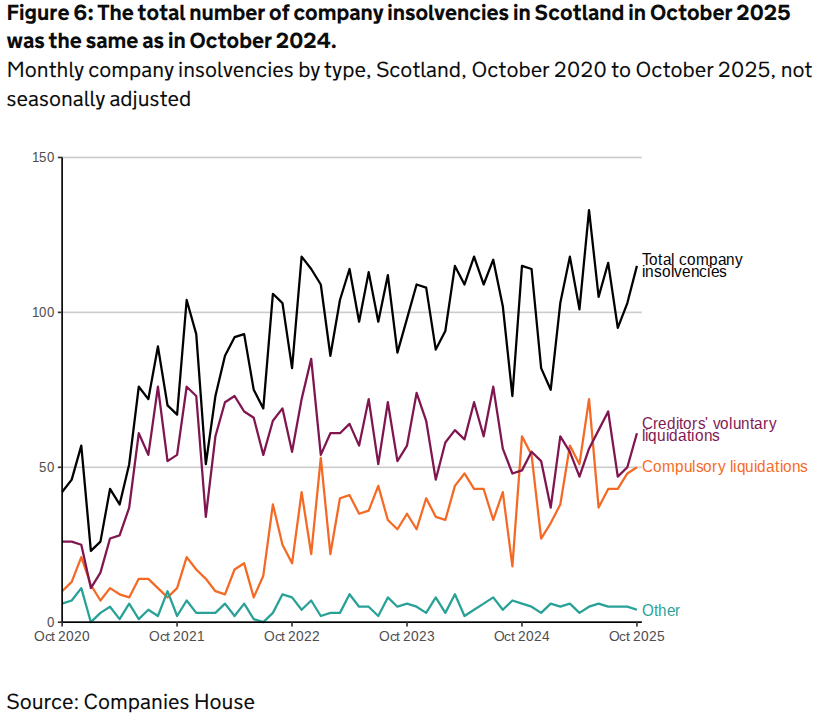

In Scotland last month there were 115 company insolvencies, which was 12 more than last month. It was exactly the same total from October 2024.

The total from October 2025 was made up of 61 CVLs (up from 50); 50 compulsory liquidations (up from 48) and four administrations (down from five). There were no CVAs (no change) or receivership appointments.

It’s important to note that Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB) is Scotland’s insolvency service and administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26th 2020 and October 31st 2025, there were three restructuring plans and one moratorium in Scotland. Both procedures were created by the Corporate Insolvency and Governance Act 2020.

Scotland has always traditionally recorded more compulsory liquidations than any other kind of insolvency procedure but CVLs overtook them in April 2020 and remained higher until a three month period from March 2025, when they retook the higher position.

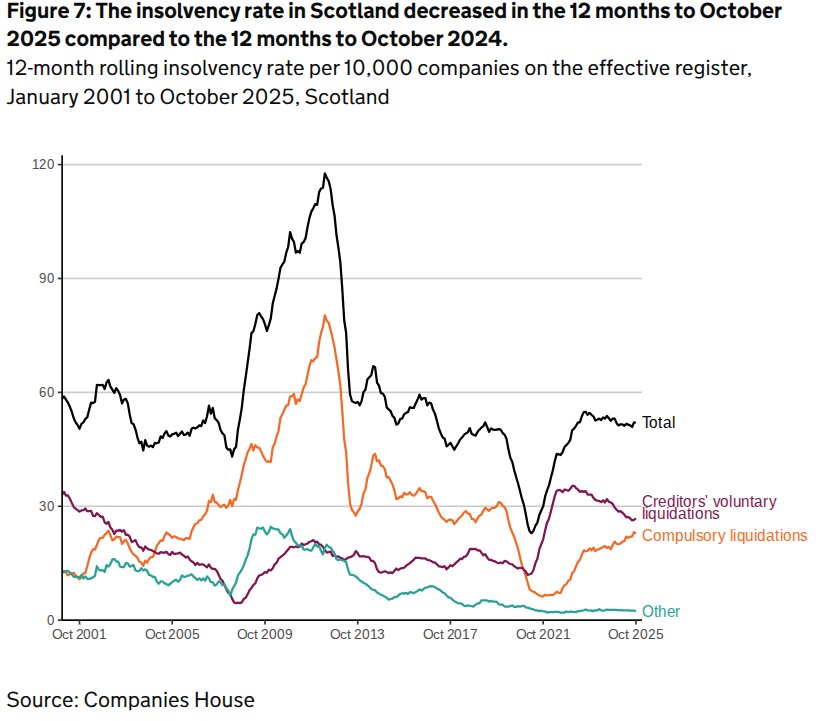

The total insolvency rate in Scotland in the 12 months up to the end of October 2025 was 52 per 10,000 companies on the effective register. This was slightly down (0.2%) from the preceding 12 months ending in October 2024.

Northern Ireland

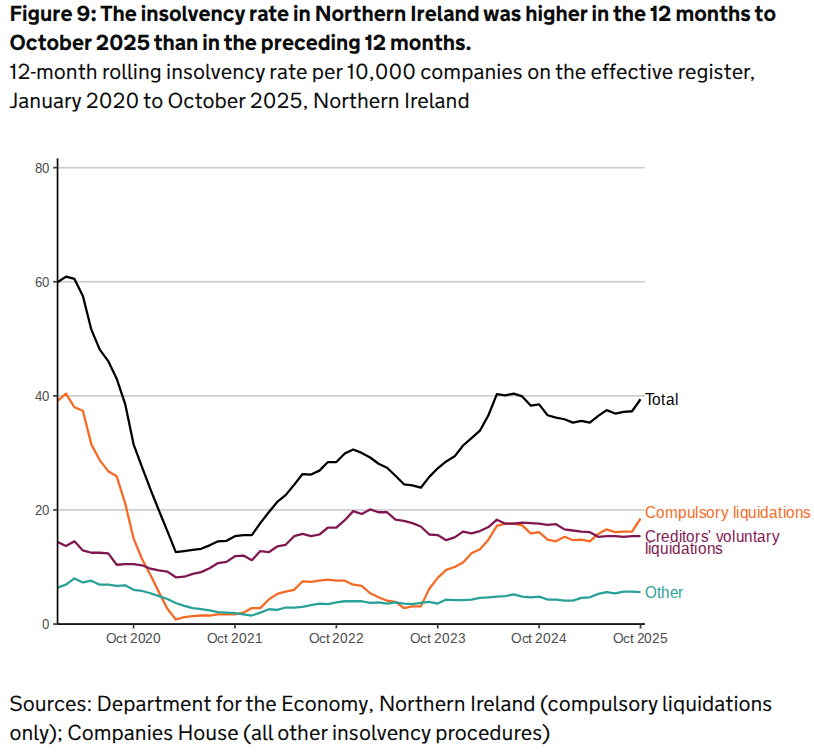

In October there were 48 company insolvencies registered in Northern Ireland. This was the second highest monthly total recorded since 2020 and was 20 higher than the number of cases registered last month (28) and 55% higher than the same period last year.

October’s total was made up of 12 CVLs (up from ten); 35 compulsory liquidations (up from 15) and one CVA (same). There were no administrations (down from two) and no receivership appointments recorded. Between June 26th 2020 and October 31st 2025, there was one insolvency moratorium recorded in Northern Ireland and no restructuring plans.

The total insolvency rate in the 12 months to October 2025 in Northern Ireland was 39.4 per 10,000 companies on the effective register. This was an increase of 2.1 from September’s total.

The total number of company insolvencies for the whole of the UK in October 2025 was 2,192 – a month-on-month increase of 61.

The pressure on businesses remains considerable

Tom Russell, President of R3, the UK’s insolvency and restructuring trade body said: “Corporate insolvencies have increased by 2% in October 2025 compared to September and are also up by 17% in the same month last year. However they are down by 11% compared to October 2023, which saw 30-year high annual numbers of insolvencies.

“The 8% increase in compulsory liquidations compared to September 2025 indicates that creditors, including HMRC, are being more aggressive in enforcing debts.

“Today’s increase in insolvencies continues a concerning trend. The figures are being published against a background of economic uncertainty with businesses and consumers alike delaying major financial decisions until they can assess the outcome of next week’s Budget.

“This hesitancy is creating a sense of stagnation, with business owners looking to the Chancellor for measures that boost growth and spending.

“The pressure on businesses remains considerable as shown by a number of high-profile insolvencies announced over the past few weeks including Pizza Hut, Tomato Energy, Sheffield Wednesday FC and Petrofac. For every failing business that hits the headlines, there are hundreds of small and medium size businesses struggling for their survival.

“Last week’s increase in unemployment to 5% indicates businesses are having to make difficult decisions about hiring and potentially, redundancy. With GDP growth also stagnant at 0.1% last quarter, business owners are contending with a difficult trading environment with higher employment, energy and materials costs.

“At the same time, creditors are becoming more proactive in forcing debts, borrowing costs remain elevated and consumer spending is subdued. These challenges underpin today’s insolvency rates and underline the need for positive, growth-focused measures in the Budget.

“Sector-specific pressures are also evident. Retailers are contending with weaker sales as consumers hold off for Black Friday discounts and save for the festive period. The British Retail Consortium has reported lower high street footfall amid fragile consumer confidence. For many retailers, the upcoming festive trading season will be pivotal, and they’ll be hoping for measures such as business rates reform and investor incentives to help stabilise their outlook.”

The first snow of the year underlines increasingly chilly weather conditions and this matches the economic environment for many businesses too.

No matter what is announced in the Budget next week, it might be the time to explore vital changes to the business to help it survive and eventually thrive in 2026.

Get in touch with us to arrange a free initial consultation about what options you could have to help your business start the new year in the best possible shape.