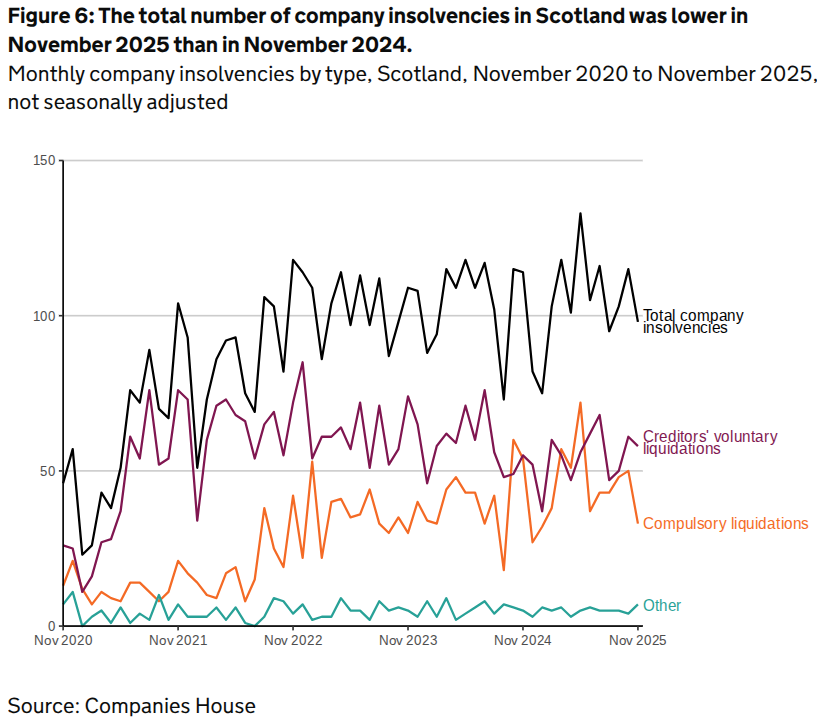

In November there were 98 company insolvencies registered in Scotland.

This was 17 fewer than the previous month and 14% lower than the number in November 2024.

The total for November was made up of 58 Company Voluntary Liquidations (CVLs) (down three); 33 compulsory liquidations (down 17) and seven administrations (up three). There were no Company Voluntary Arrangements (CVAs) (no change) or receivership appointments.

It’s important to note that Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB) is Scotland’s insolvency service and administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26 and November 30 2025, there were three restructuring plans and one moratorium in Scotland. The two procedures were created by the Corporate Insolvency and Governance Act 2020.

Scotland has always traditionally recorded more compulsory liquidations than any other kind of insolvency procedure but CVLs overtook them in April 2020 and remained higher until a three month period from March 2025, when they retook the higher position.

The total insolvency rate in Scotland in the 12 months to November 2025 was 51.2 per 10,000 companies on the effective register. This was down by 1.9 from the preceding 12 months ending November 2024.

The total number of company insolvencies for the whole of the UK in November 2025 was 2,007 – a month-on-month decrease of 185.

Chris Horner, insolvency director with BusinessRescueExpert, said: “While the reduction in insolvencies, coupled with a 0.25% reduction in interest rates announced this week are good news for the economy, their effects might not be filtering through to Scottish businesses that badly need them.

“After Hogmanay, 2026 will be on us like a January storm and if your business isn’t braced for it and ready to ride it, it could quickly get uncomfortable for directors.

“This is why you should get some impartial, professional advice as soon as you can to give you some idea on what options will be available for you to work with that could make the next 12 months and beyond easier and more enjoyable.”

As we enter the final days and weeks of 2025, the relatively good economic news will be of cold comfort if your business isn’t feeling the effects.

But 2026 does provide several opportunities for directors who want to improve and protect their business.

It starts with getting in touch with us for a free initial consultation about the options you could have to help you start the new year with a feasible plan and strategy.